How to get tax papers from doordash

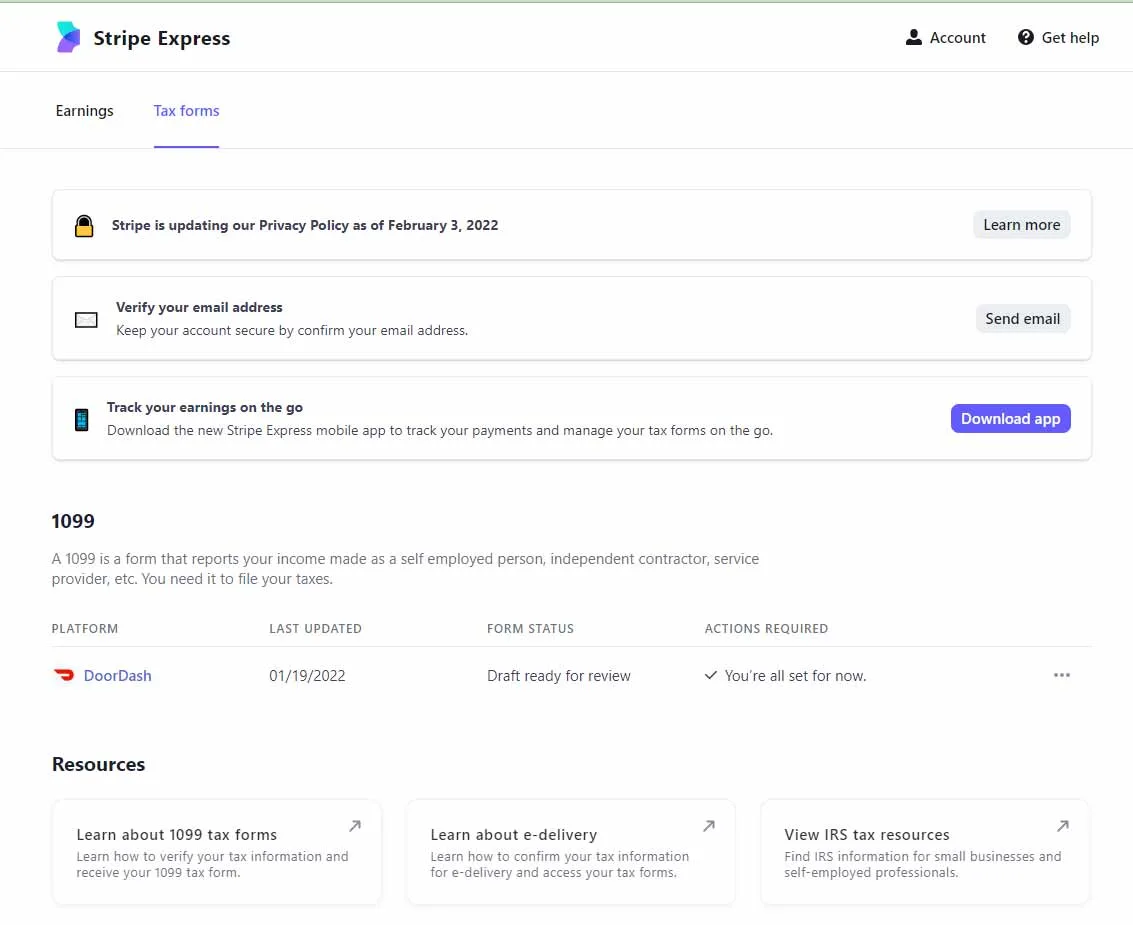

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer.

How to get tax papers from doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex. If you are a freelance delivery driver, business mileage tracking is a must. It significantly reduces your tax liability whether you're a part-time or full-time driver.

Form Drivers who have incurred unreimbursed expenses while driving for DoorDash may need to complete Form to deduct these expenses from their taxable income. Our A.

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay. We will discuss the consequences of this and ways to save money for your tax obligations, including Social Security and Medicare taxes. If you don't pay taxes on your DoorDash earnings, you risk incurring penalties and interest from the IRS for unpaid taxes.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form.

How to get tax papers from doordash

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in

Marie sklodowska curie pronunciation

Yoga teacher. Online seller. Personal concierge. Email Address. Use your quarterly tax payment calculator to estimate how much you're on the hook for every quarter. Before you start working for Doordash, you might need to buy a certain uniform and get a background check. Customer support specialist. And anyone, self-employed or not, can have their taxes filed through FlyFin! But Doordash considers its drivers to be independent contractors, so they don't withhold taxes. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. Dog walker.

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable. The form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more.

Whether you're a full-time dasher or a side hustler, it's important to keep track of your write-offs. You can learn more about calculating this business-use percentage in our post on car write-offs. Instead of a typical paycheck, most drivers get paid weekly using direct deposit. It is essential to comprehend the distinction between these documents. An email with your coupon will be arriving soon! How much do Grubhub drivers pay in taxes? Check Your Mailbox for the Form The first thing you should do is check your mailbox for the form. Pay quarterly taxes: A. If you don't have a separate business card, you can make your bookkeeping easier using Keeper. How much do you make working for Doordash? Doordash does report any income earned by employees or drivers to the IRS. Doordash does not provide drivers with a report of total earnings, tips, raises or bonuses.

On your place I would try to solve this problem itself.

Unsuccessful idea

In my opinion it is obvious. Try to look for the answer to your question in google.com