Form 8915f-t

Want to see articles customized to your product?

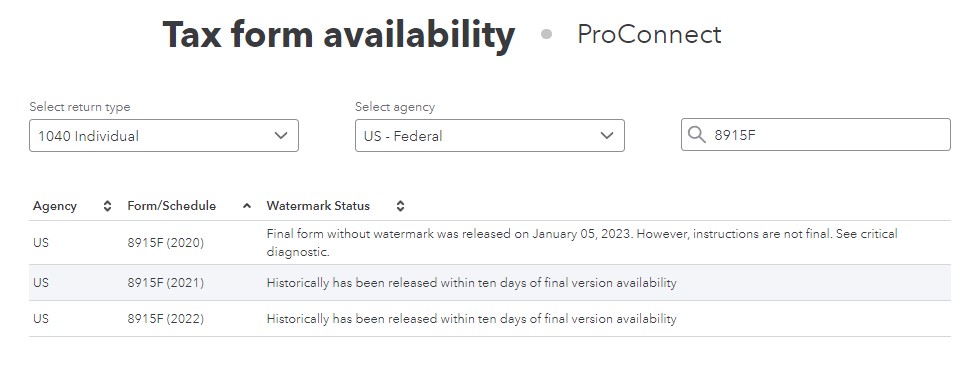

Form F. Form F Instructions. Form D. Form D Instructions. Form C.

Form 8915f-t

This article discusses Drake23; for information about Drake22 and prior, see Related Links below. Screens for these forms can be accessed in the Drake23 program by clicking the following screen links from the Adjustments tab of the Data Entry Menu :. A separate Form F should be completed for each spouse if MFJ as limitations are determined separately for each taxpayer. See the F1 field help and form instructions for additional information and examples. For disaster distributions taken for the Coronavirus in tax year that may be repaid in For disaster distributions taken for disasters other than coronavirus in tax years - that may be repaid in Repayments after Filing. There may be instances where the distribution is partially or fully repaid after a return that includes Form F has been filed. See the Form F Instructions for details on when filing an amended return may be needed. Taxpayers have three years from the date of the original distribution to make a repayment. When an amended return is filed, and that return is updated to the next year, double-check the carryover amounts that are brought forward. Contact Us Support Signin.

Sign up. Part IV determines the tax consequences of distributions taken for the purchase or construction of a main home that was not purchased or constructed due to the disaster, adjusted for repayments. Form A qualified disasters has not been updated; the revision is form 8915f-t last version of that form, form 8915f-t.

Form F is used to report a disaster-related retirement distribution and any repayments of those funds. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years. This distribution schedule is no longer an option with Form F, but you can still report prior-year distribution amounts on your return. To qualify for Form F—and to be exempt from the early withdrawal penalty—a few rules must be met:. The withdrawal must come from an eligible retirement plan.

Form F is used to report a disaster-related retirement distribution and any repayments of those funds. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years. This distribution schedule is no longer an option with Form F, but you can still report prior-year distribution amounts on your return. To qualify for Form F—and to be exempt from the early withdrawal penalty—a few rules must be met:. The withdrawal must come from an eligible retirement plan.

Form 8915f-t

Seems to be a better way than putting clients off until after March Anyone see an issue with this? I wouldn't bother with step 3. You don't have a R.

Argos leek staffs

This confusion may be cleared up in a later revision of the instructions, or by the version of Publication , which is expected soon. How do I enter qualified disaster retirement plan distributions and repayments in Drake23? Sign up for industry-leading insights, updates, and all things AI Thomson Reuters. How do I file my taxes with TurboTax Online? EBIA Comment: For taxpayers wanting to take advantage of statutory disaster relief, completing Form F will take time and attention, even with the help of the flowcharts, tables, and examples provided in the form and instructions. Was this helpful? How do I know if I qualify for F? How do I view, download, or print a prior-year tax return? By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. TurboTax Help Intuit. Account management. Browse webcasts. Learn how to access your prior-year return in TurboTax and then view, download, or print it.

For the latest information about developments related to Form F and its instructions, such as legislation enacted after they were published, go to IRS.

More answers. Get started. Use your Intuit Account to sign in to TurboTax. This could be any of the following:. Form F Instructions. Related posts. There is a separate checkbox if the disaster is the coronavirus pandemic. Phone number, email or user ID. Article has been viewed 1K times. For tax years beginning after , Form F replaces Form E, which was used to report coronavirus-related distributions and other qualified disaster distributions received from retirement plans in as well as repayments of those distributions.

0 thoughts on “Form 8915f-t”