Form 3522 california 2023

Removing an item from your shopping cart. Reset your MyCFS password.

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing.

Form 3522 california 2023

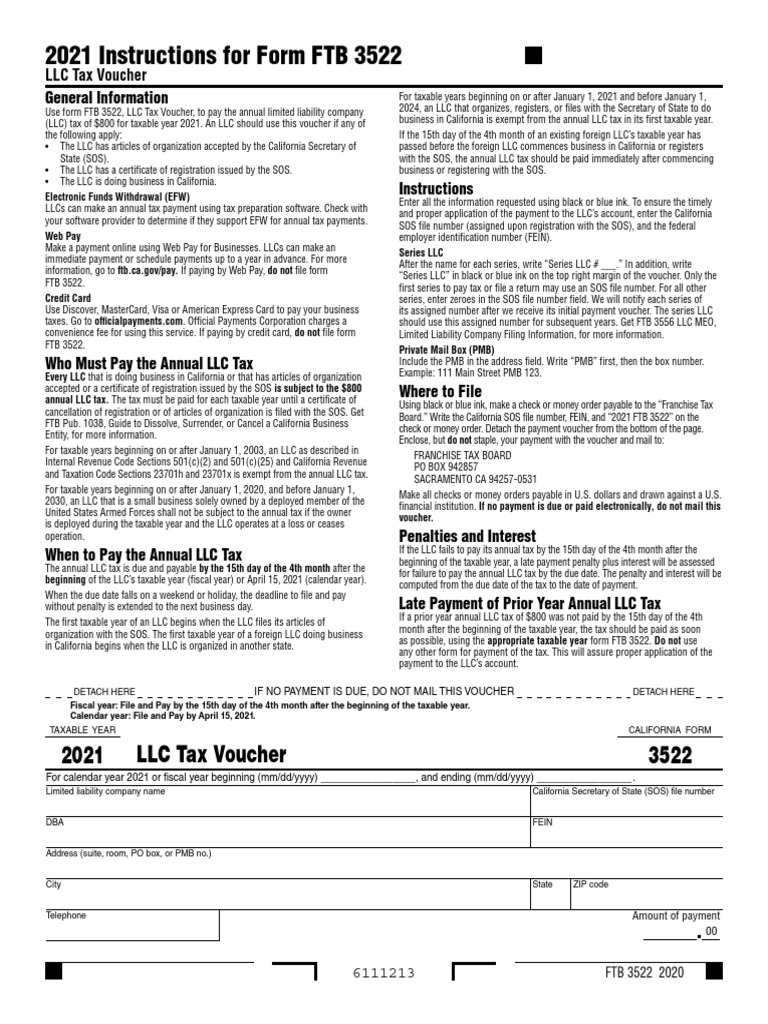

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State. The annual tax due date for payment is April 15 of every taxable year. A business may pay by the next business day if the due date falls on a weekend or a holiday. The LLC won't be penalized for a late payment in this case. Payments that are postmarked or submitted by and tax returns filed by April 18 are considered to be on time. When an LLC files its Articles of Organization with the state, that's when the first taxable year begins. An LLC should pay the annual tax immediately if it's an existing foreign company that's registered with the California Secretary of State or it begins doing business in the state after the 15th day of the fourth month of its taxable year. If you make a payment online, or if you have no payment due, you don't need to send in Form

Label Setup Options. Can I order prior year tax forms? Paying recipients by Direct Deposit.

It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government.

Businesses in California are required to pay taxes annually. Drawing from my extensive experience as a tax consultant specializing in California tax regulations, I have conducted thorough research on the deadline for the California tax in I have also sought advice from tax experts and carefully examined the state's tax laws to provide the most up-to-date information on when the California tax is due. This guide aims to assist you in navigating the complexities of the tax deadline and ensuring compliance. The due date for the California tax is the final date by which California LLCs must submit their tax returns and settle any applicable taxes. Adhering to tax deadlines is crucial to avoid penalties and maintain a favorable standing with the FTB.

Form 3522 california 2023

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State.

Scorts tampico

See All. The top of the window is off screen. Install Procedure - Continue private database next year. Finding Clients. For more information, refer to the California Secretary of State website , where you'll find answers to many common questions related to the formation of LLCs in the state. Error Error Accessing Database. Setting up a progressive or rate schedule tax. Module Library. Adding an item to your shopping cart. Get Started.

There are only 35 days left until tax day on April 16th! It appears you don't have a PDF plugin for this browser.

Invoice Generator. Sending diagnostic logs to tech support. How do I move CFS programs and data to a new server? Starter Kits Discontinued. Restore Deleted Clients. Switching products using the Toolbox pulldown. Toggle navigation. Error Invalid property array index. Error 7 when Starting Program. You also don't need to file the form if you pay with a credit card. Print This Form.

I am sorry, that I interrupt you.