First republic bankstock

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San FranciscoCalifornia. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. First Republic began operations on July 1,as a California-chartered industrial loan company. Infirst republic bankstock, First Republic sought to shift to a banking charter first republic bankstock expand its offerings.

First Republic Bank signs and logos rest near a parking space, below, and on the exterior of a bank branch location, above, Wednesday, April 26, , in Wellesley, Mass. First Republic Bank signs and logos are attached to a window at a branch location, Wednesday, April 26, , in Boston. First Republic Bank signs and logos rest on the exterior of a branch location, Wednesday, April 26, , in Boston. The San Francisco bank plans to sell off unprofitable assets, including low interest mortgages it provided to wealthy clients. It also has plans to lay off up to a quarter of its workforce, which totaled about 7, employees at the end of last year.

First republic bankstock

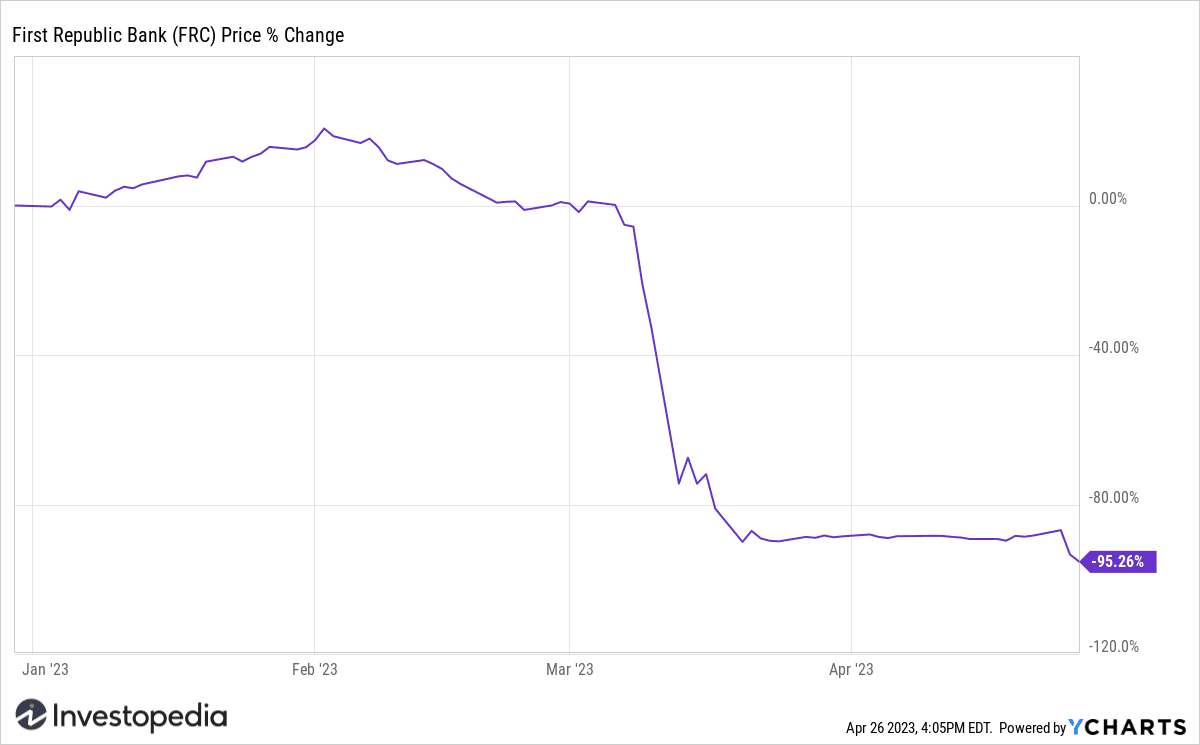

While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. Now, some analysts are declaring the show is over for First Republic. The root of the issue is twofold: Similar to SVB, First Republic had many of its holdings in long-term bonds that were bought back when interest rates were low, and when interest rates went up, those were suddenly worth far less, which was the piece of information that triggered the bank run at SVB. Also akin to SVB, First Republic is a regional, Silicon Valley—based bank that caters largely to wealthy businesses and high-net-worth individuals. Why is this an issue? According to its recent balance sheet , on Dec. The vast majority of these uninsured customers are businesses. Wealthy business clients also have the resources to pull their money out as soon as they start seeing alarm bells. However, 11 large U. While executives and advisors at First Republic have been trying to engineer a sale for weeks, the bank is not an attractive buy. Teams of advisors managing billions are packing up and hopping ship—taking their high-net-worth clients with them to new employers. One thing is for sure, nobody is getting out of this mess unscathed. But who—between the investors, depositors, and the government—takes the biggest loss depends on what happens next. Wedbush equities analyst David Chiaverini explained that there were three most likely cases for the path forward. The one that is the most speculated about is that the financial institution goes into receivership and the FDIC takes over, which is similar to what happened with SVB.

CBRE : Therefore Moneycontrol doesn't bear any responsibility for any trading losses you might incur as a result of using this data. This is part of the first republic bankstock the stock has been driven so low, according to Chiaverini—investors are fleeing at the potential dilution of their stake.

In a year rife with economic challenges and market uncertainties, JPMorgan Chase JPM , the titan of the American banking sector, emerged with a remarkable financial narrative for The bank's journey Commercial real estate companies have had a tough go of it as the Federal Reserve raises interest rates at the fastest pace in decades. A top government official says Turkish President Recep Tayyip Erdogan supports his new economic team's plan to increase interest rates to lower the country's soaring inflation. Business these days in Jackson Hole, Wyoming, is still good — just not as robust as it was after the U. The Banc of California has agreed to buy PacWest Bancorp in an all-stock transaction, bringing an end to months of speculation about whether PacWest could survive on its own after the failures of three Shares are mostly lower in Asia as optimism over a Wall Street rally was countered by worries about the Chinese economy.

Shares of JPMorgan Chase rose 2. Regional bank shares slid. Shares of PacWest Bancorp slipped Shares of First Republic Bank remained halted from early Monday morning. Meanwhile, the latest ISM manufacturing report revealed that manufacturing activity contracted for the sixth straight month in April. The Federal Reserve begins its two-day monetary policy meeting Tuesday, which is expected to conclude with a quarter-point rate hike.

First republic bankstock

Search markets. News The word News. My Watchlist. Business Insider logo The words "Business Insider". Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Home Stocks First Republic Bank-stock. Start Trading Add to watchlist. New: Online Broker Comparison!

Green bay packers vs carolina panthers match player stats

Covered Calls Naked Puts. Wedbush equities analyst David Chiaverini explained that there were three most likely cases for the path forward. While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. After the passage of the law, the Nevada thrift became a state-chartered bank, First Republic Savings Bank. Hidden categories: Pages with non-numeric formatnum arguments Webarchive template wayback links Articles with short description Short description is different from Wikidata Use mdy dates from April Commons category link from Wikidata Official website different in Wikidata and Wikipedia Articles with VIAF identifiers. Contact Barchart. March 1, Barrack, Jr. Archived from the original on September 29, All Press Releases Accesswire Newsfile. Retrieved April 28, The Bank provides investment management, May 1, Investing News Tools Portfolio. They are derived by market makers in CFD OTC market and hence prices may not be accurate and may differ from the actual market price, meaning prices are indicative only and not appropriate for trading purposes.

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY

February 28, Wealthy business clients also have the resources to pull their money out as soon as they start seeing alarm bells. Advanced search. Go To:. FOX Business. January 13, Save this setup as a Chart Templates. Reserve Your Spot. BLK : Shares are mostly lower in Asia as optimism over a Wall Street rally was countered by worries about the Chinese economy. Learn Barchart Webinars.

I can recommend to come on a site where there is a lot of information on a theme interesting you.

I advise to you to come on a site where there is a lot of information on a theme interesting you. Will not regret.