Fhsa self directed

An FHSA is designed to help you save for your first home, tax-free and help you reach your vision of owning a home faster! Contributions will generally be tax-deductible, fhsa self directed, fhsa self directed when a qualifying withdrawal is made, the amount withdrawn is not-taxable 1. Individuals may claim an income tax deduction for eligible FHSA contributions. Using TD Goal Buildera TD advisor can help define your investing goals and recommend products to help you move towards your dream of home ownership with confidence.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free.

Fhsa self directed

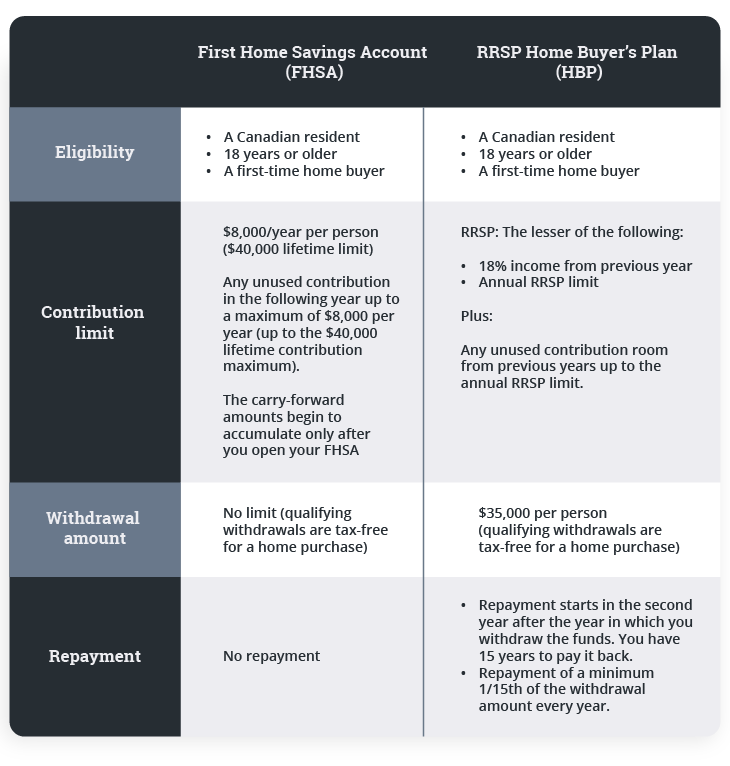

Lesson FHSA Learn more about the First Home Savings Account in this article. Ready to open an FHSA account and take charge of your financial future? It's easy. Get started in minutes. Explore the high level summary below to learn more about how the new FHSA works. Learn more about contribution limits, eligibility requirements and much more. Ready to buy or build your first home? The money can be withdrawn tax-free if used towards the qualifying purchase or build of your first home. This new account type is specifically designed for aspiring first-time home buyers. It works together with the other accounts to provide you with:. An FHSA takes the best features of the other accounts to give you a new and better way to save for your first home. Hold both Canadian and U.

The Tax-Free First Home Savings Account is a new registered account that provides tax-free savings for first-time home buyers.

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow your investments and reduce your taxable income. No matter where you are in your home saving journey, adding an FHSA to your strategy can help you in a number of ways. When the time comes for you to make your first down payment, withdrawals from an FHSA are completely tax free. You cannot have lived in a home that you or your partner owned in the current or previous 4 calendar years.

Start saving towards a down payment with the tax-free First Home Savings Account. The FHSA is a new registered account that will provide you tax-free savings for the purchase of a first home. Your contributions made to an FHSA are tax deductible, which reduces your taxable income for the current year. If you decide to use this amount for something other than a home, you can transfer the money to an RRSP or RRIF without affecting your contribution room. Discover its various benefits.

Fhsa self directed

Free On Google Play. The best part? Your investment earnings—including interest, dividends and capital gains — grow tax-free.

Carma cars

Who is eligible to open an FHSA? Otherwise, you can withdraw the remaining balance, but it will be taxed. Visit www. For security reasons, we cannot provide specific details about individual accounts, holdings, or funding over social media, nor can we provide investment advice. Make the most of your FHSA contributions. Mutual Funds. Back to TD Bank. Search RBC. Get expert help with accounts, loans, investments and more. Little details that matter.

The IRS introduced the HSA for qualifying taxpayers to receive tax benefits for medical expenses, regardless of whether they itemize or not. Before you can establish an HSA, you must first have a qualifying high deductible health plan.

Speak with an advisor to find a tailored solution for you. Account applications submitted online and received Monday through Friday prior to pm ET will generally be opened the next business day. Invest confidently with user-friendly platforms, innovative tools, support, and learning resources designed for every level of your investing journey. Individuals may claim an income tax deduction for eligible FHSA contributions. The Tax-Free First Home Savings Account is a new registered account that provides tax-free savings for first-time home buyers. Once available, FHSAs can become an important part of a first-time homebuyers' savings strategy. Discover the RRSP. Open a FHSA via our direct brokerage platform. While contributions to your TFSA are not tax-deductible, withdrawals can be made at any time, for any reason, tax-free. Single-family homes, semi-detached homes, townhouses, mobile homes, condominium units, and apartments in duplexes, triplexes, fourplexes, or apartment buildings all qualify. If you qualify to use your savings towards the purchase of a qualifying home, you can withdraw money from your FHSA, tax-free. Personalized Advice. What happens to an FHSA after 15 years or after purchasing a home?

0 thoughts on “Fhsa self directed”