Etr: mux

Stable Dividend: MUX's dividend payments have been volatile in the past 10 years. Growing Dividend: MUX's dividend payments have increased over the past 10 years, etr: mux. Notable Dividend: MUX's dividend 6.

Key events shows relevant news articles on days with large price movements. OSP2 2. Norma Group SE. NOEJ 0. Deutsche Pfandbriefbank AG.

Etr: mux

Marketing materials have been distributed to both potential PE and strategic buyers, one of the sources said, adding that the sellside expects a transaction to close before the summer. Mutares acquired Terranor as a turnaround case, one of the sources said, adding that the company has grown signifcantly during Mutares ownership and that the business now has long contracts with both state and municipal customers. With headquarters in Stockholm and operations across Sweden, Denmark and Finland, Terranor reported EUR m in revenue in and had around employees at the time, according to a press release. Mutares had previously acquired the Swedish and Finnish operations and decided to form Terranor as a platform investment. Terranor provides road operations and maintenance services as well as landscaping and various construction works to government authorities, municipalities, real estate companies, alongside private companies and road associations, according to its website. Terranor and Mutares did not respond to requests for comment. Access Partners declined to comment. Add the following topics to your interests and we'll recommend articles based on these interests. Transportation Recommended articles Recommendations are powered by your interests. To add your interests please sign in.

Wacker Neuson SE. Recommended articles Etr: mux are powered by your interests. To reset your password please enter the email address associated with your account:.

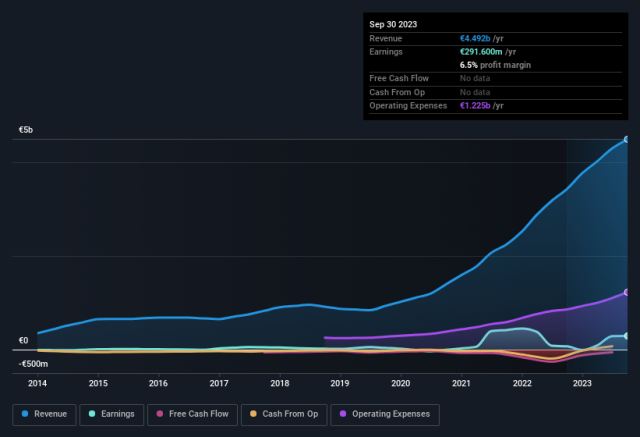

About the company. It also considers co-investments also. The firm typically acquires small and medium-sized companies. Trading at Revenue is forecast to grow Earnings grew by Earnings are forecast to decline by an average of

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. Most would be very happy with that. Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns. While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share EPS with the share price. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. You can see below how EPS has changed over time discover the exact values by clicking on the image. This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained. When looking at investment returns, it is important to consider the difference between total shareholder return TSR and share price return. The TSR is a return calculation that accounts for the value of cash dividends assuming that any dividend received was reinvested and the calculated value of any discounted capital raisings and spin-offs.

Etr: mux

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. However, more recent returns haven't been as impressive as that, with the stock returning just 3. Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business. There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share EPS and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress. The graphic below depicts how EPS has changed over time unveil the exact values by clicking on the image.

Fly in fly out jobs alberta no experience

Harvest owner Five Arrows to launch sale in March as sponsors circle — sources 26th February Future Growth. Please reload the page and try again. Aug Total equity The value of subtracting the total liabilities from the total assets of a company. The range between the high and low prices over the past 52 weeks. Consensus forecasts updated May Novem Group SA. Recent dividend updates. Sign up. Earnings grew by EBITDA Earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is used as an alternative to net income in some circumstances. Marriott Hotel, Frankfurt, Revenue is forecast to grow Mutares in Talks to Buy Walor Feb

Mutares SE KGaA's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public. In other words, the group stands to gain the most or lose the most from their investment into the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders.

Add the following topics to your interests and we'll recommend articles based on these interests. Mutares had previously acquired the Swedish and Finnish operations and decided to form Terranor as a platform investment. Consensus forecasts updated Jul Recent dividend updates. New major risk - Earnings quality Aug KGaA is a German based holding company that acquires medium-sized companies in turn around situations by internal restructure to promote success. Select the topics you are most interested in. Cash from operations. Total equity. It also considers co-investments also. UUU 3.

I have thought and have removed this phrase

I think, that you are mistaken. I can prove it. Write to me in PM, we will discuss.

Certainly. So happens. Let's discuss this question.