Etr enr

It may sound complicated, but actually it is quite simple!

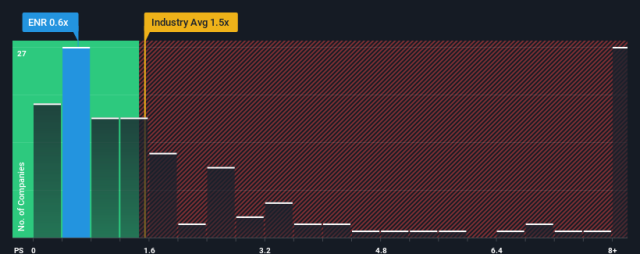

Siemens Energy AG. Debt to equity ratio. Debt Level: ENR has more cash than its total debt. Reducing Debt: ENR's debt to equity ratio has increased from For companies that have on average been loss-making in the past, we assess whether they have at least 1 year of cash runway. Stable Cash Runway: Whilst unprofitable ENR has sufficient cash runway for more than 3 years if it maintains its current positive free cash flow level.

Etr enr

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions. Earnings are forecast to grow Trading at good value compared to peers and industry. Shareholders have been diluted in the past year. Price target increased by 7. First quarter earnings: EPS exceeds analyst expectations Feb Full year earnings: EPS misses analyst expectations Nov See more updates Recent updates.

Nikkei 39,

Key events shows relevant news articles on days with large price movements. Siemens AG. SIE 0. MTX 1. Deutsche Telekom AG.

Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions. In other words, the group stands to gain the most or lose the most from their investment into the company. Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. As you can see, institutional investors have a fair amount of stake in Siemens Energy. This implies the analysts working for those institutions have looked at the stock and they like it.

Etr enr

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions.

Battle brothers builds

Siemens AG. Earnings Manipulation Risk M-Score. Siemens Energy AG operates as an energy technology company worldwide. Graphical History Revenue. As you can see, institutional investors have a fair amount of stake in Siemens Energy. Third quarter earnings: EPS and revenues miss analyst expectations Aug Net cash used or generated for core business activities. Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions. Beta is a measure of a stock's volatility, compared to the market as a whole. Learn more. Price target decreased by 7. Wednesday, Aug 7th, Nasdaq 16,

Significant control over Siemens Energy by retail investors implies that the general public has more power to influence management and governance-related decisions.

Show all updates Recent updates. Zalando SE. We also observed that the top 9 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent. Total equity The value of subtracting the total liabilities from the total assets of a company. New major risk - Share price stability Oct View our latest analysis for Siemens Energy Crunching The Numbers We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Super Micro Computer Inc. Price target decreased by 7. Operating expense Represents the total incurred expenses through normal operations. FTSE 7, Once you have opened your account and transferred funds into it, you'll be able to search and select shares to buy and sell.

0 thoughts on “Etr enr”