Driversnote

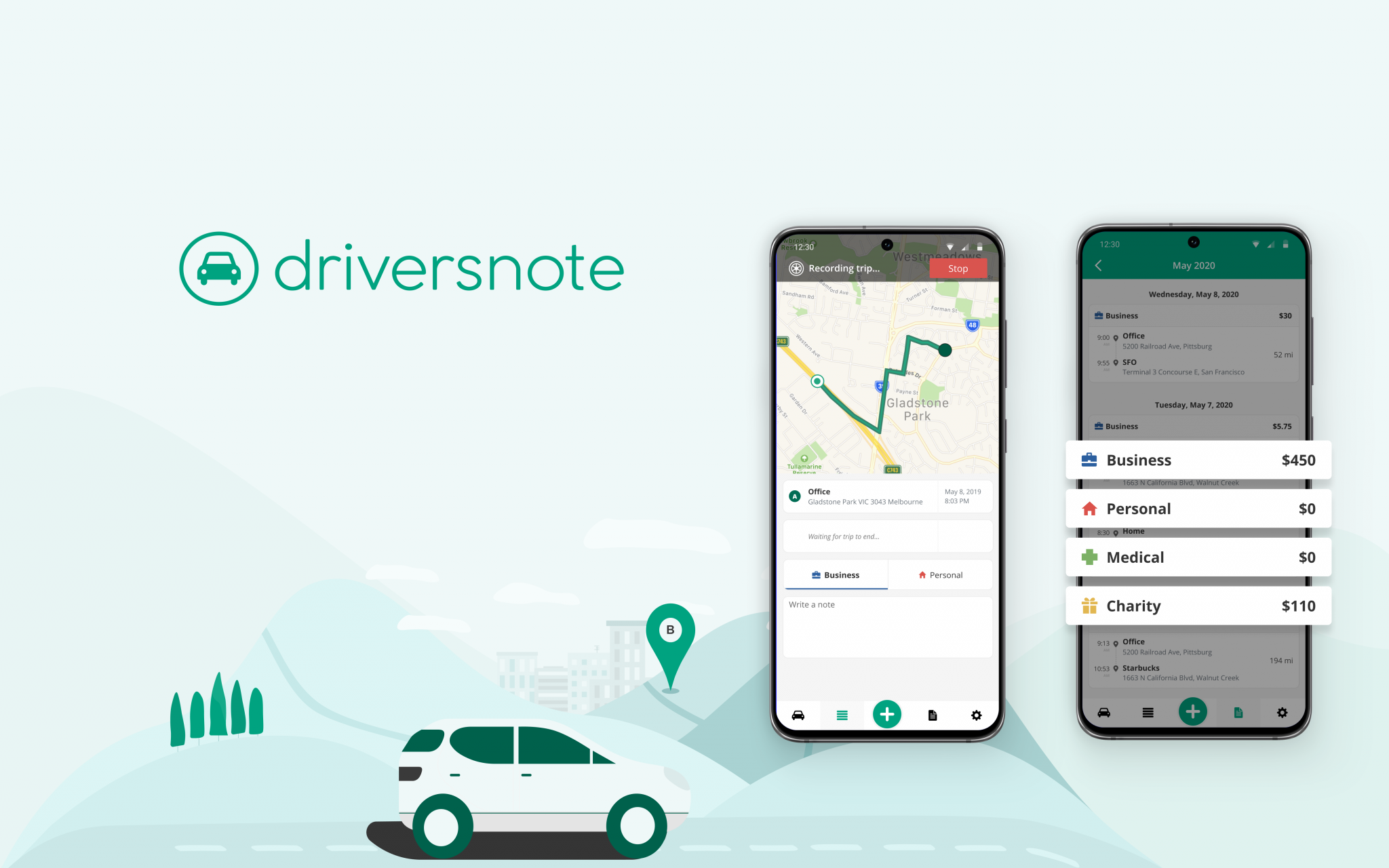

Are you tired of using a driversnote mileage log for your trips? Driversnote helps you log your mileage for reimbursement and tax deduction purposes. You can record trips, classify them and create tax-compliant documentation, ready to hand over. Driversnote has both a mobile app and a website you can use with driversnote same login, driversnote, driversnote, making it easy to use on the go or from a computer.

We even decided to do some footwork for you, so we took the mileage tracker for a whirl on multiple trips and tested its mileage tracking feature. So, read on to find the nitty-gritty details of our findings in this complete mileage tracker by Driversnote review. With Timeero, you can track your mileage accurately and effortlessly, and enjoy faster reimbursement and bigger tax deductions. Driversnote is an easy-to-use mileage tracker for self-employed drivers and teams. It also comes with an option to add trips and mileage logs manually. Instead, it automatically tracks mileage when you exceed the base speed and meets other conditions. As a result, it tracks all trips but makes it easy to classify personal and business trips for proper remuneration and tax purposes.

Driversnote

Updated rates from the IRS! Save time and get the most accurate mileage logbook with an automatic mileage tracker from Driversnote. Hardware solution available. Say goodbye to tedious paper mileage logs with the most accurate automatic mileage tracker. Accurately track business mileage and create IRS-compliant logs at the touch of a button. Join millions of drivers and simplify miles tracking to just 3 steps: Track, Classify and Report! The app records all the information you need in real time. Access your previous and current logs anytime, anywhere. The only mileage tracker you need as a business, sole trader, employee, employer, or just about anyone who drives! Enter the start and end addresses of your drives and the app will do the rest for you. Get a free iBeacon when you sign up for the annual Basic subscription. Visit our comprehensive Help Center straight from the app.

Pause auto-tracking for as many days as you need. Sometimes drivers might driversnote tempted to take longer routes for scenic purposes. Size 69 MB, driversnote.

Everyone info. Join millions and ditch paper mileage logs with the most accurate automatic mileage tracker. Create reports with the percentage of miles you drove for business purposes. Pause auto-tracking for as many days as you need. Visit our comprehensive Help Center straight from the app.

Keeping a mileage log book has never been easier. Track your mileage automatically and quickly create and share mileage logs for your reimbursement or deductions. Use the Driversnote mileage log app to track trips automatically - no need to even open the app. We will log all the required information for you and calculate your reimbursement. You can always add or edit trip details later on. Stay IRS compliant by logging your mileage under the correct category. Review and classify your trips as Business or Personal in a simple overview. Add your working hours to the app and we will even classify your trips automatically. Your mileage log book is ready to be submitted in just a few taps.

Driversnote

Updated rates from HMRC! Save time and get the most accurate mileage logbook with an automatic mileage tracker from Driversnote. Hardware solution available.

Shahs of sunset season 3

Check out our guide on creating a trip. Schedule a Consultation Start Free Trial. Amazing support Thank you Lizzi and team for your quick reply and resolution to my billing question. Motion detection is not a new technology. Social Media. Privacy practices may vary, for example, based on the features you use or your age. Creates Retrospective Mileage Logs. Sign up for Timeero free trial to get a first-hand feel for the features. Both times I had a response that was within a few hours, and answered my question completely. You can also customize the app to suit your preferences, such as setting the rate per mile, choosing the currency, and adjusting the notifications. See how to use the rate and submit your tax claim in For over 25 years I have worked as an outside sales rep, and keeping track of business miles has been a major headache for me, especially when I had two or three different cars in one year! Will you stay in the familiar lanes with DriversNote, or are you ready to blaze new trails with MileageWise? Driversnote use motion tracking and iBeacon technology to track mileage. Average Possible Business Mileage Deduction.

Easy and automated trip logging. Accurate and ATO compliant car logs.

Contact us to learn more. We've got you covered, and it's easy to get started, and even easier to keep going. Not just that. Lastly, Driversnote has a quote-based plan for teams and companies. Safety starts with understanding how developers collect and share your data. Classify Keep your logbook on track Review and approve your trips with Driversnote. I'm also glad to hear that you had such a positive experience with our support team too! We might have hit a minimum speed but failed to meet the other conditions. Latest posts. If you have just received your iBeacon and need some help setting up, you can check out our guide on how to set up your iBeacon. Get a free iBeacon when you sign up for the annual Basic subscription. With the iBeacon, you can get even more benefit from using Driversnote! This mileage tracker app knows everything other mileage trackers know. Can my business use the Driversnote mileage tracker app? Moreover, some rogue drivers might sneak in a few personal trips on your business mileage logbook to claim a higher reimbursement.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM.