Cost of ufile

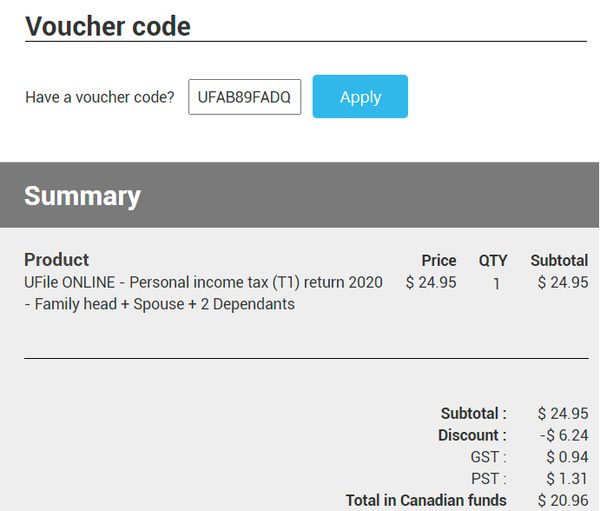

That is why they are priced accordingly. As they do provide the same features, have the same interface, and are very straight forward and easy to follow, each cost of ufile is presented differently.

Are you a post-secondary student? Is yours a simple return? Are you filing a Federal tax return for the first time? You must be a resident of Canada, have tuition fees and have attended school for at least one month during the tax year being prepared. Tuition credits that are not used or transferred to a supporting person in the current year will be carried forward by UFile for future use by the student.

Cost of ufile

Post by NormR » 17Nov Post by snowback96 » 18Nov Post by ole'trader » 18Nov Post by snowback96 » 19Nov Post by Insomniac » 26Nov Post by AltaRed » 26Nov Post by chufinora » 27Nov Post by kumquat » 09Dec Post by AltaRed » 09Dec Post by kcowan » 09Dec Post by NorthernRaven » 22Dec

Tax credit for home-support services for seniors - Family head younger than spouse - Quebec. You will then have the opportunity to answer Yes or No to the following questions: Is the individual regarded cost of ufile a dependant senior? Applying net capital loss from previous years.

Complete the security question answer. Click "Submit". Once you have completed these steps, you will receive an email with the reset information. Click on the link in the email received for the reset: 2. This link will open a page where you must enter a NEW password and enter it again; 3. Click on the box "I am not a robot", then "Reset";.

That means these products have gone through rigorous testing and been found to be quality products. Well, now you have. UFile must be doing something right! There are many ways to file your taxes in Canada, not just with UFile. Here's a guide that will show you the benefits of using UFile. Disclaimer: The content in this article or page is for informational purposes only. Users may choose to visit the actual company website for more information.

Cost of ufile

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. Filing taxes is something most people have to do each year in Canada, but sometimes it can be a hassle. Here, we take a closer look at UFile, reviewing its features, plans, pros and cons, and comparing it with other popular tax software like TurboTax and Wealthsimple Tax. The UFile tax software is a popular choice for many Canadian taxpayers who want a simplified and straightforward way of filing their tax returns.

Plasma donation gainesville fl

Designation of a property as a principal residence. This information is believed to be from reliable sources but may include rumor and speculation. Designation of a property as a Principal residence. Please email feedback ufile. Northern residents - Travel expenses - T RRSP - Refund of excess contributions. Once you are satisfied with your tax return and have paid UFile's fees, your computer can print your tax return on plain paper using the program Adobe Acrobat Reader. T4A P slip - Where to enter information. RRSP contributions. Northwest Territories - Political contribution. To determine if your account was rolled over. However, if your dwelling type for the year is one of the following: Lived in own house Lived in a rented apartment Lived in a condominium these questions are not available and should be. T - RRSP spousal transfers. Most Internet users already have Adobe Reader. Add or remove a family member.

But the good news is there are several situations where you can file for free — including having a simple tax return. Other than these options, UFile offers all the standard tax software features — including express notice of assessments , an accuracy guarantee , and some prior-year import options — but skipped out on making an app version of their service.

Saskatchewan - Labour-sponsored venture Tax Credit. Ontario - Ontario Trillium Benefit. CCA limitation to be claimed. Reserve on disposition - T Tax credit for home-support services for seniors - No calculation advanced payment same as tax credit. UFile is not a third party filing your tax return for you. UFile may be installed on up to 2 computers. Several T4 slips and only one RL Balance owing - CRA. Account - Email address how to change Federal line different from Quebec line Additional returns Add 2 more tax returns to your existing software.

0 thoughts on “Cost of ufile”