Core msci world usd acc

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Core msci world usd acc

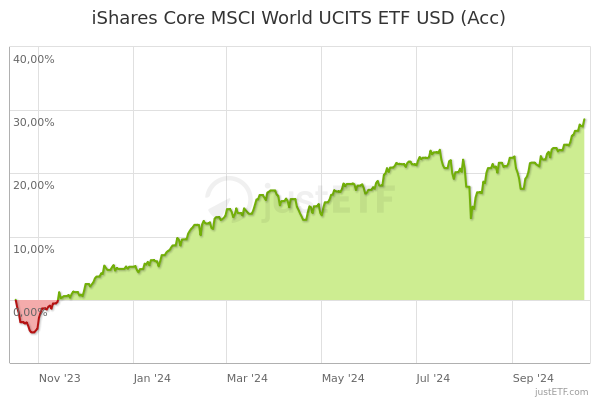

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the following requirements:. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. Please note that the above summary is provided for information purposes only. If you are uncertain as to whether you can both be classified as a professional client under the Markets in Financial Instruments Directive and classed as a qualified investor under the Prospectus Directive then you should seek independent advice. Discover the world of ETFs. The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund core msci world usd acc a third-party the Borrower. The metrics are not indicative of how or whether ESG factors will be integrated into a fund. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, core msci world usd acc, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction.

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English. Private Investor Professional Investor.

Key events shows relevant news articles on days with large price movements. SCHD 0. SWRD 0. CSPX 0. CNDX 0. VWRL 0. IMAE 0. VUAA 0.

Core msci world usd acc

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

Yakuza merida

All financial investments involve an element of risk. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Aug Favourable What you might get back after costs Average return each year. Product Structure Physical. The figures do not take into account your personal tax situation, which may also affect how much you get back. Skip to content BlackRock BlackRock. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. Risk Indicator Risk Indicator 1. The approval comes just a day after an 'unauthorised' social media hiccup announced Bitcoin spot ETFs had been approved by the US regulator. Note, only corporate issuers are covered within the calculation. Mar

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance.

What is the ITR metric? Privacy policy. What are the key assumptions and limitations of the ITR metric? However, there is no guarantee that these estimates will be reached. Investors should read the fund specific risks in the Key Investor Information Document and the Prospectus. Increase Decrease New since last portfolio. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. Interesting ETF investment guides. Percentage of Fund not covered as of What you will get from this product depends on future market performance. Minimum There is no minimum guaranteed return. Skip to content BlackRock BlackRock.

I with you completely agree.