Commbank goal saver account review

Fact checked. It now has almost branches scattered across the country, 49, employees,shareholders and about 16 million customers. A savings account gives you a place to store your moneybut these banking products tend to differ from bank to bank.

Help us improve our website by completing a quick survey. Start survey now. Update now. Personal Bank Accounts. Save time by using NetBank. Register now. An everyday bank account with competitive interest for pensioners or retirees over 55 years of age or are at least 18 years of age and receive an eligible pension.

Commbank goal saver account review

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access. Transactions are unlimited and you'll be able to get one free assisted withdrawal per month, but these and other statement requests will come with a fee thereafter. If you've got a larger savings balance which you're willing to keep adding to, the Commonwealth GoalSaver could potentially be a suitable place to store your funds. If you don't meet the conditions of making at least one monthly deposit and growing your account balance, the interest rate reverts to a considerably lower 0. Make a deposit each month and have a higher account balance at the end of the month compared to the start of the month excluding interest and bank-initiated transactions. My goal saver account has been terrific to help me grow a house deposit. As long as you don't withdraw funds, and make even just one deposit each month, the interest and bonus interest is really good.

A savings account gives you a place to store your moneybut these banking products tend to differ from bank to bank. Westpac Life - years old. Online Banking.

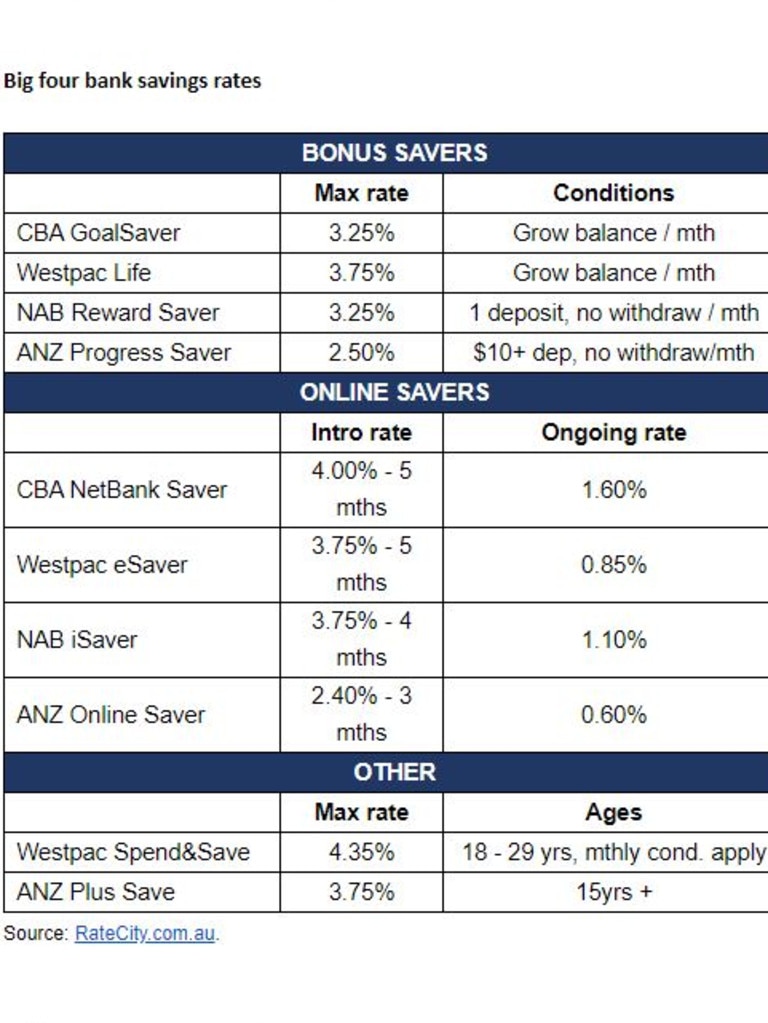

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This is a lower interest rate compared to the highest rate accounts on the market which offer higher interest rates. However, CommBank has one of the best mobile banking apps in Australia which could be a big benefit of this account if you like to manage your money on the go. The app can help you budget and save by splitting your transactions into spending categories, helping you find benefits and rebates that you might be eligible for and reminding you of upcoming bills. The Commonwealth Bank Goal Saver Account pays bonus interest when you meet the monthly deposit conditions and make no withdrawals from the account.

The CommBank GoalSaver high interest savings account offers rates up to 4. Sign in. CommBank GoalSaver Account. Fact checked and verified. Updated 15 March Top Pick. Judo Bank Personal Term Deposit.

Commbank goal saver account review

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up.

Sharp grossmont lab hours

Interest calculated daily and paid monthly The standard variable rate of 0. Transactions are unlimited and you'll be able to get one free assisted withdrawal per month, but these and other statement requests will come with a fee thereafter. To do this, you must complete three online steps:. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. SMSF Accounts. Oddly, I was advised by commbank at a branch that it was a condition…. A mixture of a savings and transaction account, the Pensioner Security Account gives seniors the ability to spend while also earning a return on their money. She covers all areas of personal finance, and her areas of expertise are superannuation, banking and saving. The Netbank Saver earns you interest on your money while also giving you complete access to it. What's not Low standard 0. Based on Commonwealth Bank savings account reviews. You do not pay any extra for using our service. Learn more about our editorial policy. Ratings are just one factor you may want to consider when choosing a financial product.

Open in NetBank. Open now. Earn bonus interest when you grow your savings balance each calendar month excluding interest and bank-initiated transactions.

Bendigo Bank Reward Saver. Access your money online, in branch or over the phone. See all bank account FAQs. If you wish to open a trust account, please apply at any branch. You can also set it up as a joint savings account. High term deposit rates The term deposit interest rates are very competitive depending on what set term you choose compared to some of the other big four banks. The all-in-one everyday banking account with the flexibility you need. It's simple to apply. Our ratings have been determined without considering your personal objectives, and a product with a high rating may not be the best one for you. NetBank NetBank is a secure online experience. If Commonwealth Bank is unable to verify your identity electronically, you may be asked to visit a branch to complete this step. Mastercard and the Mastercard brand mark are registered trademarks of Mastercard International Incorporated. Link to your everyday account. Cash Mgmt Accounts.

What magnificent words