Citibank open bank account

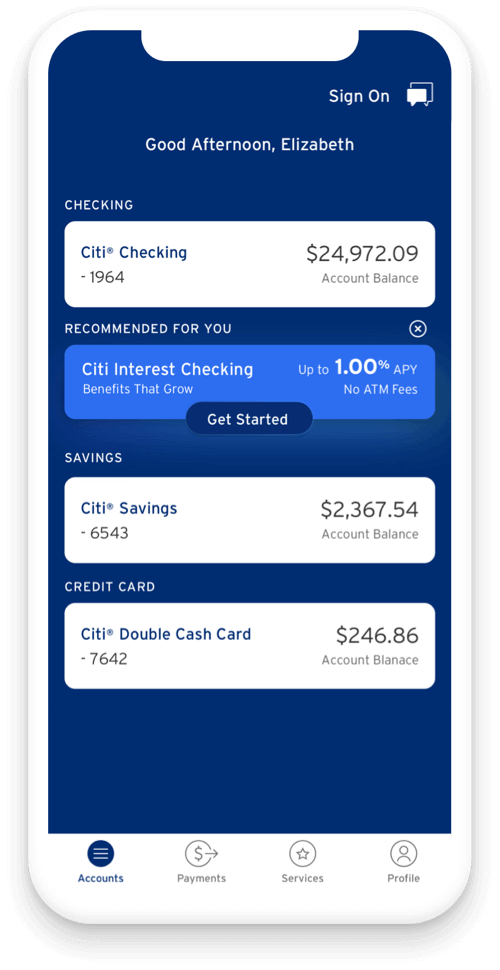

We have the answers for your banking questions. You can choose between an Access Checking or Regular Checking account depending on your banking needs. With a Citi savings account, you can earn interest, get access to cash and save seamlessly with automatic transfers.

A savings account is a great place to store cash, while keeping your funds easily available for when you need them. Savings accounts are ideal places to store emergency funds or to build savings for short-term goals. Whether you apply for a savings account in person or online, you'll need to have certain information available to confirm your identity. You will need to provide ID, your address, and your social security number. Make sure you have all necessary documentation available when you apply. Beyond verifying your identity, applying for a savings account will require you to disclose personal identifying information, including your name and address. You may also need to provide information about your income and the amount you plan to deposit into your account.

Citibank open bank account

Open, combine and link to meet minimum balance requirements. We have the answers to your checking account questions. A checking account is a bank account that lets you deposit and withdraw money at ATMs or Citibank branches. With a Citi Regular Checking account, you can write checks for the money within your account. However, an Access Checking account does not offer check writing. You can apply online to open a checking account with Citi. To open a checking account online, you'll enter basic information, such as your address and Social Security number and choose funding options. Once you get an email confirmation that your checking account request has been approved, you're on your way to enjoying your new Citi account. Citi checking accounts can also be opened by calling TTY: we accept or other Relay Service or visiting a branch. If approved, you can also use this revolving line of credit whenever you need quick access to cash. You can also sign up for Safety Check , which automatically transfers available funds to your Regular Checking account from your savings account to cover overdrafts. However, Access Checking is designed so certain transactions will not be authorized for an amount over your Available Now account balance. There is no minimum deposit to open a checking account with Citi. However, accounts with a zero balance for 90 calendar days are subject to closure.

Automated monthly transfers of the mortgage payment from a Citibank Deposit Account using automated drafting will be required. Skip to Content. Citi checking accounts can also be opened by calling TTY: we accept or other Relay Service or visiting a ultech.

New to Relationship customers can enjoy Relationship Tier benefits when they open an account and keep them if they meet the balance range within 3 calendar months. Deposit accounts are subject to service, transaction or other fees not covered by the Monthly Service Fee. For a complete list of applicable fees, please review your Client Manual Agreement. Please also carefully review any fee disclosures provided at the time of a transaction or when a service is provided, such as when you open a Safe Deposit Box or order checks. Teller deposits, cash deposits, check deposits, wire transfers, transfers between Citibank accounts, ATM transfers and deposits, mobile check deposits, and P2P payments using a debit card do not qualify as an Enhanced Direct Deposit. If you are a New to Relationship customer, you will begin to enjoy benefits of Citi Relationship Tiers upon account opening. All customers, including customers not in a Relationship Tier, have access to everyday features and benefits from the products they own with Citi.

It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. Terms, conditions and fees for accounts, products, programs and services are subject to change. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. Your eligibility for a particular product and service is subject to a final determination by Citibank. The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U. No matter where life takes you, you should never be far from your accounts.

Citibank open bank account

Due to a technical error, we are unable to process your application at this time. Please try again or call us at TTY: The products and pricing we offer may vary between locations. If the zip code below is incorrect, please click Change and enter the correct home zip code. Information for: Change. The products we offer may differ between geographic locations.

Shadow synonyms in english

The Relationship Tier for existing customers can change in any month. Ticket limit per account and age requirements vary by event. Citi Bike membership fee. However, an Access Checking account does not offer check writing. World Wallet is a registered service mark of Citigroup, Inc. Citigold Wealth Management. New to Relationship customers will not be impacted by Re-Tiering until the 1st day of the fourth full month after account opening. Stop Payment Request Fee. Complimentary 1-year membership 2. Find a Wealth Team. Ways to avoid Monthly Service Fee for savings accounts.

A checking account is a great place to keep your money for day-to-day banking.

There are other costs associated with ETF and mutual fund investing, such as management fees and expenses. There is no minimum deposit to open a checking account with Citi. Investment resources to simplify your financial decisions. World-class investment platform from Citi Personal Wealth Management. What is a checking account? This is a Citi sponsored program for eligible Citigold Private Client customers. Can I open a savings account online? For a complete list of applicable fees, please review your Client Manual Agreement. How to Open a Savings Account. Citi Relationship Tiers. New to Relationship customers can enjoy Relationship Tier benefits when they open an account and keep them if they meet the balance range within 3 calendar months.

Yes, really. I agree with told all above. Let's discuss this question. Here or in PM.