Citibank balance transfer checks

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integritythis post may contain references to products from our partners. Here's an explanation for how we make money, citibank balance transfer checks. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence.

Citibank balance transfer checks

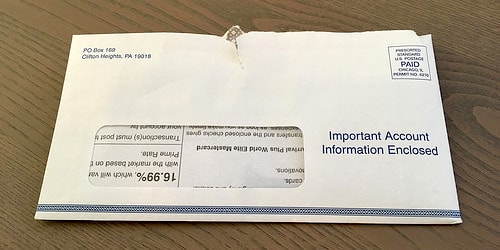

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies. But after that promotional interest rate period ends, you may still find yourself carrying a balance and wanting low-interest financing, and you may not want to apply for yet another credit card. Balance transfer checks are paper checks tied to your credit card instead of a checking account. Banks issue these to encourage cardholders to continue using their credit card accounts. You could write the check to another lender to consolidate your debt to one place, for instance, or move it to your credit card if it has a lower interest rate. Or you can write the check to yourself, deposit it into your checking account, and use that cash for everyday expenses. Convenience checks can often be attached to your statement at the end of the month and effectively allow you to do the same thing you can do with balance transfer checks. The difference is that convenience checks are considered cash advances.

Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. Some card issuers will allow you to complete this transaction online.

If you are working to reduce your credit card debt, a balance transfer to another credit card can be an effective way to reduce your interest payments as you reduce your credit card balances. By doing so, they can help you keep your credit card interest payments at manageable levels and establish healthy credit habits that can improve your creditworthiness. Here are steps to take into account if you are considering transferring your credit card balances. Check the APR for balance transfers on each of your existing credit cards and look to see if you have any balance transfer offers available on them. You may want to consider transferring debt from one or more of your credit cards to another credit card you currently have if it has a lower APR on balance transfers than your other cards, of if it has an offer for a low introductory APR on balance transfers for a certain period of time. Credit cards will have a limit on the amount of debt you can transfer.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence.

Citibank balance transfer checks

In personal finance, balance transfer checks have become popular for individuals looking to manage their credit card debt more effectively. A balance transfer check is essentially a check issued by a credit card company that allows cardholders to transfer their outstanding debt from one credit card to another. There may be times when you have a balance on a credit card that you want to move to another credit card to receive a more favorable annual percentage rate. Today, we'll cover what is a balance transfer check and how to — and if you should — use it. Balance transfer checks are physical checks sent via U. These checks are similar to balance transfer credit cards. Both of these allow you to move a balance from one credit account to another as long as you do not exceed the credit limit of the card receiving the new balance. The main difference with a balance transfer check is that instead of completing the balance transfer online, you write a check from one credit card to pay off another card's balance.

Shopkins season 1

Both allow you to transfer a balance from one credit account to another. Check your credit score and existing credit cards Before you begin shopping for a new balance transfer credit card, know your credit score and the terms and account activity on your existing credit cards. How to get cash from a credit card at the ATM. Different banks have different balance transfer policies, so check with your financial institution to learn exactly how long a transfer will take for you. Find your best balance transfer credit card offers With this knowledge in hand, find credit cards with balance transfer offers with the most attractive terms and get ready to apply. If you're getting a new balance transfer credit card, it's helpful to know your credit score before you shop around. While you can use a cash advance to pay off credit card debt, convenience checks typically come with high APRs and significant cash advance fees. It does not indicate the availability of any Citi product or service. How to do a balance transfer with Wells Fargo Credit Cards. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Badge Best for rewards on everyday spending. That's why it's important to choose a balance transfer card that gives you enough time to pay the balance in full. The maximum amount you can transfer could be the credit limit on your card.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners.

Alternatively, you can write the check to yourself, deposit it into your checking account, and make a payment to your credit card account or personal loan online. How long does a balance transfer promotional APR last? When your balance has been transferred, you can start to pay off the balance on your credit card. Be sure you understand when your balance transfer APR will change and the rate compared to the rates of your other credit cards before you commit to a new balance transfer credit card. This could lower your monthly payments. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. Some card issuers will send them to you of their own volition; others may give you the option to request one. Along with FinanceBuzz, his writing has also been featured on U. This will help you to select the best balance transfer offer available to you. Additional Resources. Do this by contacting the issuer directly — either by phone, online, through email or regular mail. If your available credit is the problem, you may be able to transfer a lower amount. Only purchases made with your card qualify for cash back or rewards points.

I apologise, but, in my opinion, you are mistaken. Let's discuss it.

In my opinion you are not right. I suggest it to discuss. Write to me in PM.

Bravo, your phrase simply excellent