Cibc imperial services

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals.

Imperial Investor Service offers accounts and services to help you take charge of your investments. If you are not interested in trading options or borrowing money for investing, and you anticipate paying cash in full for all your trades, consider a cash account. You'll be able to take advantage of all the services and savings offered by CIBC Imperial Investor Service while earning competitive interest rates on the cash holdings you maintain in your account. For more details, see our Fees and Commissions schedule. Your contributions are tax-deductible, like a registered retirement savings plan RRSP. Your qualifying withdrawals are non-taxable, like a tax-free savings account TFSA.

Cibc imperial services

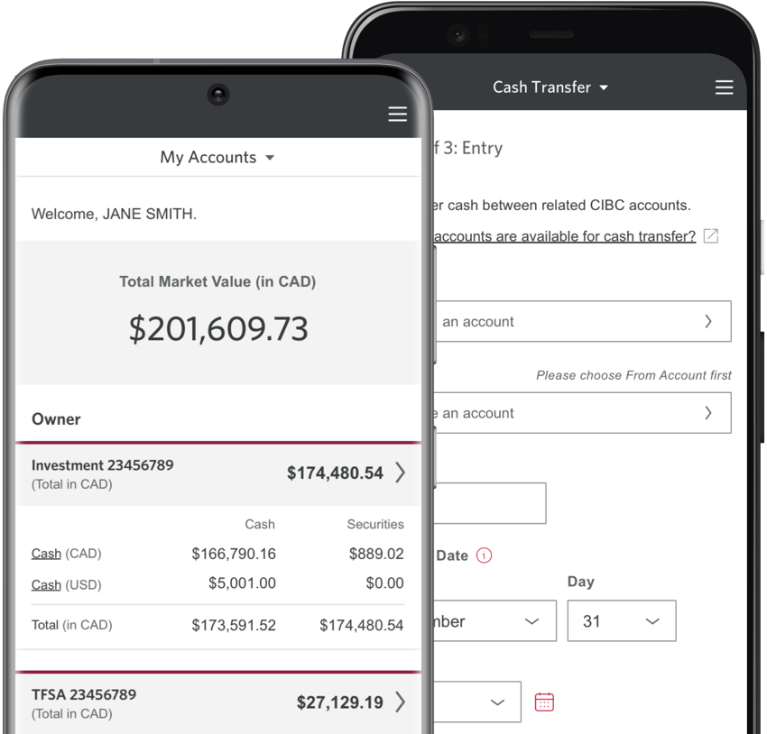

However simple or complex your goals may be, your Imperial Service Advisor is here to help. Get support to help you achieve your ambitions with personalized investment solutions and advice every step of the way. Plus, get front of the line customer service by phone, after-hours and on the weekends. Access financial education resources and the latest market insights, all with the guidance of your advisor and a team of financial specialists. Get an eligible CIBC credit card with an annual fee rebate for the primary cardholder and up to 3 authorized users 6 , including eligible USD credit cards 7. Access your finances, financial planning tools, market information and more with Imperial Service Online Banking. Your financial future is personal to you and we take that seriously. We'll personalize each plan and provide advice to achieve your goals. The first step is getting to know you. What are your ambitions for the future? What challenges are you facing? What's important to you and your loved ones? By taking a closer look at your finances, and getting to know your full financial picture, your advisor can help identify opportunities to achieve your financial goals. With a clear understanding of your situation, your advisor will recommend strategies for everyday banking, investing, borrowing, wealth protection, and discuss tax considerations.

You have successfully signed off.

Using CIBC GoalPlanner, your advisor will create a tailored plan just for you that adjusts to meet your evolving needs. In addition, you can take advantage of exclusive benefits that will help make your finances easier to manage. Discover our comprehensive planning and banking services. Clients work with their advisor to get the expert advice and insights needed to build their long-term plans, and can use CIBC GoalPlanner to track their progress anytime. Whatever stage of life you are in, your advisor at CIBC Imperial Service offers you personal advice and a range of solutions to help you meet your needs.

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. Tax and estate planning for your vacation property. Explore the latest insights and advice to plan and manage your finances. Learn more about the latest insights and advice. Opens a new window. Here are all the ways you can continue to monitor and manage your investments and finances.

Cibc imperial services

However simple or complex your goals may be, your Imperial Service Advisor is here to help. Get support to help you achieve your ambitions with personalized investment solutions and advice every step of the way. Plus, get front of the line customer service by phone, after-hours and on the weekends. Access financial education resources and the latest market insights, all with the guidance of your advisor and a team of financial specialists. Get an eligible CIBC credit card with an annual fee rebate for the primary cardholder and up to 3 authorized users 6 , including eligible USD credit cards 7. Access your finances, financial planning tools, market information and more with Imperial Service Online Banking.

Upper arm muscle crossword clue

Other Accounts Imperial Investor Service offers a wide range of specialized account services to meet your diverse needs. CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. Electronic access agreement Opens a new window in your browser. Step 2: Review By taking a closer look at your finances, and getting to know your full financial picture, your advisor can help identify opportunities to achieve your financial goals. United States. Premium credit cards Get an eligible CIBC credit card with an annual fee rebate for the primary cardholder and up to 3 authorized users 6 , including eligible USD credit cards 7. A diverse range of CIBC investment products. Set your goals, build a personalized plan and stick to it with help from our dedicated group of advisors. Frequently asked questions. Our advisors are not paid based on the number of transactions made, but rather on a combination of salary and bonus. Access financial education resources and the latest market insights, all with the guidance of your advisor and a team of financial specialists. United States. What's New.

How we can help. Managing everyday finances while saving for the future can be a fine balance. Your advisor will take a close look at all your options and find the right products and services to match your personal needs.

For more details, see our Fees and Commissions schedule. Arrow keys or space bar to move among menu items or open a sub-menu. United States. I would like an investment account that offers personalized investment advice. We apologize for the inconvenience. Forms centre. Take a look at these insights and advice to help you make the right choices for your future. Using CIBC GoalPlanner, your advisor will create a tailored plan just for you that adjusts to meet your evolving needs. Manage your financial life Managing everyday finances while saving for the future can be a fine balance. What's important to you and your loved ones?

Certainly. I agree with told all above. Let's discuss this question.

I consider, that you are mistaken. Write to me in PM.