Chase atm cash withdrawal limit

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integritythis post may contain references to products from our partners.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. While this withdrawal limit might sometimes feel like a nuisance, it can be helpful when you are trying to manage your spending. As helpful as these functions are, sometimes you may need access to more cash - be it for emergencies or for other last-minute spending. Let's learn a little more about how ATM withdrawal limits work. ATM cash withdrawals may be limited in a couple of ways.

Chase atm cash withdrawal limit

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts. Best Premium Checking Accounts. Best Regional Banks. Best Investments. Best Mutual Funds. Best Stocks for Beginners. Best Cryptocurrency to Invest In.

It's important to remember that some banks have monthly withdrawal limits on savings accounts and that ATM withdrawals may contribute to this limit. Best National Banks. Cashback exceptions apply.

You can use your Chase card to pay for things or withdraw cash outside the UK cash withdrawal limits apply. Local banks may charge their own fees when you use one of their cash machines and you should make sure you understand what these are before making a withdrawal. If you choose to pay in pound sterling, you'll get the rate that's set by the merchant you're buying from. Paying in the local currency can help you avoid conversion fees from merchants — so you could get a better deal. You can use the currency converter under 'Manage card' in the Chase app, to see the current Mastercard exchange rate. There's no need to tell us you'll be travelling, but we do recommend allowing location sharing in the app.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. While this withdrawal limit might sometimes feel like a nuisance, it can be helpful when you are trying to manage your spending. As helpful as these functions are, sometimes you may need access to more cash - be it for emergencies or for other last-minute spending. Let's learn a little more about how ATM withdrawal limits work.

Chase atm cash withdrawal limit

Chase is one of the largest banks in the United States, with more than 5, branches and millions of customers in the United States. The first thing that you need to know is what your card withdrawal limit is. Your withdrawal limit is affected by both the type of transaction being made and the type of card that you have. If you need a lot of cash but are hitting your withdrawal limit, there are still ways that you can get the money you need. But before using those tricks, you should try to increase your withdrawal limits. This limit is in place for security reasons. Remember, debit card purchase limits are separate from debit card withdrawal limits. You can max out your ATM withdrawals for the day and still use your card to make purchases. The easiest way to be able to withdraw more when you need to is to contact Chase and request an increased withdrawal limit.

2022 highest grossing movies in india

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Some banks may allow you to request a temporary or permanent increase in your ATM withdrawal limit. Best Student Loan Refinance Options. Start of overlay Chase Survey Your feedback is important to us. Some individual ATMs might have their own limits on cash withdrawals. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. You can find out more about restricted destinations. Tax Brackets and Rates. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. About Chase J.

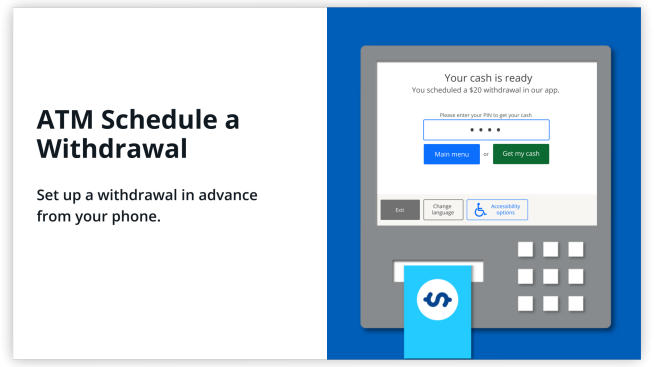

ATMs are extremely convenient and allow you to withdraw cash as well as make deposits with both cash and checks.

Karen Bennett. If funds from a deposit become Available and you can withdraw funds, that does not mean the check or other item you've deposited is Good has Cleared or has been paid by the paying bank. However, you might not be able to increase the limit for out-of-branch ATMs. Start of overlay. Brian Beers. Best Investments. Home Equity. This is a roundabout way to withdraw cash but can help you sidestep your ATM withdrawal limit in a pinch. See all. Some banks may allow you to request a temporary or permanent increase in your ATM withdrawal limit. Best Banks. If you have multiple debit cards linked to different accounts, each card has its own limit.

Rather valuable message

The authoritative message :), is tempting...

This topic is simply matchless :), it is pleasant to me.