Car loan wells fargo calculator

At this time, car loan wells fargo calculator, Wells Fargo Auto loans are only available through dealerships. With a network of nearly 11, dealerships nationwide, be sure to ask the dealership if Wells Fargo Auto financing is available to you. If your loan is funded by Wells Fargo Auto, we'll service your account.

Add advanced info. Calculated your loan? Now find your car! Compare a wide range of new and used cars in one place to find the right match for the loan amount and terms you calculated. Enter your preferred loan details to see loans that match your selections. Use this auto loan calculator to estimate a monthly car payment and total loan cost based on information you input — such as vehicle price, interest rate, down payment amount, trade-in value, length of the loan, sales tax rate and registration fees.

Car loan wells fargo calculator

Buying a new car means a fresh car smell and the newest features. But they have a higher price tag, higher rate of depreciation and more expensive insurance. Use a new vs. Determining if you want to buy or lease your new car requires consideration of the number of miles you plan to clock on the vehicle odometer as well as how much you can afford each month. When you lease a car , you have the right to use the vehicle but do not have full ownership. Think of it as borrowing the car for a set amount of time, usually three or four years, but not holding complete rights to the car. There will be specific restrictions in terms of use. With a lease, you will be restricted to a certain number of miles driven and the expectation to return the vehicle in mint condition — or incur fees. You likely will find leasing options through dealerships, which can be a great option if you have your sights set on a specific model. Leasing is worth exploring if you are interested in driving more expensive vehicles every few years rather than keeping one car for the long term. Leasing also has incentives , such as the ability to drive a higher-end vehicle, cash rebates, manufacture warranty and subsidized residual values. Before you drive a car off the lot, you need to decide if you should lease or buy it. Consider three main factors: the number of miles you drive annually, the purpose of the vehicle and how much you can afford to spend monthly. Buying may be best if you want full ownership of the vehicle and can afford a higher monthly cost.

Putting any amount down will help lower what you finance and the total cost of the loan. If your vehicle is under warranty, or if you purchased a service contract, your vehicle may be covered. Additional principal payments When you pay more than the total amount due, on or before the due date, the additional amount will pay down your principal balance and will be applied to your next payment due, car loan wells fargo calculator.

Gain confidence in your plan by making sure your numbers make sense. Estimate loan payments, projected overhead, and debt load to help you with your decision. You can also estimate how long it may take to get a return on your investment ROI. Whether you're looking to start a new practice, expand an existing one, purchase new equipment or upgrade technology, use this calculator to estimate your monthly loan payment. Want to pay down your debt more quickly? See how much faster you'll pay off an existing loan by adding a fixed amount to your monthly payment. There are errors in one or more fields below.

Buying a new car means a fresh car smell and the newest features. But they have a higher price tag, higher rate of depreciation and more expensive insurance. Use a new vs. Determining if you want to buy or lease your new car requires consideration of the number of miles you plan to clock on the vehicle odometer as well as how much you can afford each month. When you lease a car , you have the right to use the vehicle but do not have full ownership. Think of it as borrowing the car for a set amount of time, usually three or four years, but not holding complete rights to the car. There will be specific restrictions in terms of use.

Car loan wells fargo calculator

Gain confidence in your plan by making sure your numbers make sense. Estimate loan payments, projected overhead, and debt load to help you with your decision. You can also estimate how long it may take to get a return on your investment ROI. Whether you're looking to start a new practice, expand an existing one, purchase new equipment or upgrade technology, use this calculator to estimate your monthly loan payment. Want to pay down your debt more quickly? See how much faster you'll pay off an existing loan by adding a fixed amount to your monthly payment. There are errors in one or more fields below. See highlighted fields.

Wireclub

What you should know about auto financing. The amount of your payment allocated to interest is calculated based on your unpaid principal balance , the interest rate on your loan, and the number of days since your last payment. To request the information needed for this authorization, please call us at , Monday — Friday, 8 am - 6 pm, local time. Other DTI ranges. No: Taxes and fees are paid out of pocket by the borrower. The tools and calculators on the Wells Fargo Practice Finance website are provided for educational and illustrative purposes only. Payoff date The date the loan will be paid off in full. How much will my refund be? But you also borrow more against the equity in your vehicle and roll that amount into your refinance loan. Price of vehicle. You can pay off your loan at any Wells Fargo banking location and a Wells Fargo account isn't required. Customer experience: Our team looked at how easy it is for customers to apply for and manage their loans. But they have a higher price tag, higher rate of depreciation and more expensive insurance.

Find out more about EVs. Have peace of mind knowing your vehicle is financed through an auto lender with more than 50 years of experience.

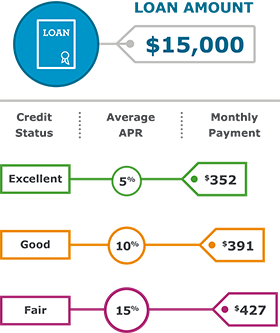

How do I pay off my auto loan? Call us for more information or if you need assistance making a payment. What happens if I paid more money than the payoff amount? To figure in additional expenses. The amount of money you are eligible to borrow is based upon several factors, including your credit and financial history. Total Monthly Payment. Select a rating Excellent and above Good Fair Poor and below Please select a credit rating. When deciding on a loan term. Auto Loans. Sign on and then select Statements and Documents.

Excuse, that I interfere, but you could not give little bit more information.

Bravo, this remarkable phrase is necessary just by the way