Capital one checking account fees

A successful middle ground for your money.

Jednolita Rada ds. Restrukturyzacji i Uporządkowanej Likwidacji, Europejski Urząd Nadzoru Bankowego i nadzór bankowy EBC z zadowoleniem przyjmują kompleksowy zestaw działań podjętych wczoraj przez organy szwajcarskie w celu zapewnienia stabilności finansowej. Europejski sektor bankowy jest odporny i charakteryzuje się solidnym poziomem kapitału i płynności. Ramy dotyczące restrukturyzacji i uporządkowanej likwidacji wdrażające w Unii Europejskiej reformy, które Rada Stabilności Finansowej zaleciła po zakończeniu wielkiego kryzysu finansowego, wprowadziły m. W szczególności pierwszymi instrumentami, które pokrywają straty są instrumenty w kapitale podstawowym i dopiero po ich pełnym wykorzystaniu wymagane byłoby umorzenie instrumentów dodatkowych w Tier I. Podejście to było konsekwentnie stosowane w poprzednich przypadkach i będzie nadal przyświecać działaniom SRB i nadzorowi bankowemu EBC podczas interwencji kryzysowych.

Capital one checking account fees

.

Jednolita Rada ds.

.

March 16, 4 min read. Virtually any checking account will provide these basic services. But if you want to find an account that really fits your needs and budget, there are a few other factors worth considering. Under 18? Banks may allow you to get a checking account if a parent or legal guardian is willing to be co-owner of the account.

Capital one checking account fees

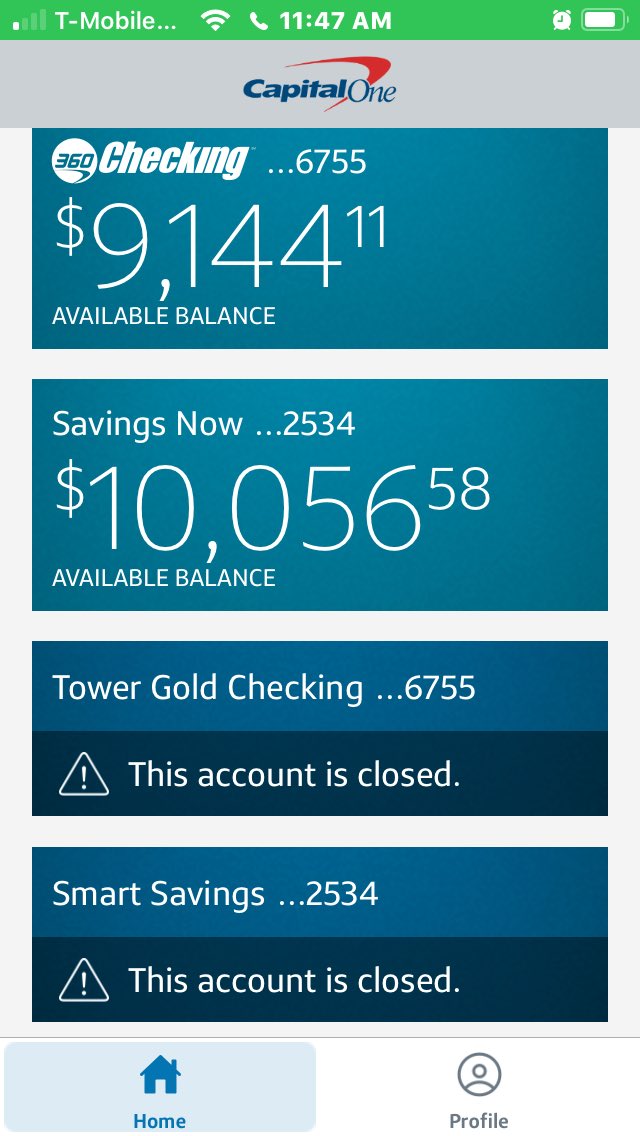

Capital One stands out with one of the best combinations of online bank perks — no checking or savings fees, a competitive savings rate and high CD rates — and a brick-and-mortar presence. Editor's note: On Feb. Here's what that would mean for customers. There's no minimum balance required, and if you end up withdrawing early, the most you pay is six months' worth of interest, even for five-year terms. Some banks charge a year of interest. No monthly fee and interest-earning: It's somewhat rare to find a no-monthly-fee checking account that pays interest, but Capital One Checking does: 0. There's also no opening balance requirement. High app ratings and multiple support options: Capital One accounts boast some of the best mobile experiences for a bank, earning high ratings from both iOS and Android users.

Charlotte emily fnaf

This seemingly unassuming strategy provides passive income without directly investing money in volatile markets — equating to stable and safe returns, and with very little risk. Figure 1: A visualization of the differences between types of savings accounts. Just like with bonds, in the short term, the user agrees to earn a fixed amount of interest for a fixed amount of time on the money they invest. Consumers can actually benefit from rising interest rates in an incredibly simple way: by putting their money in alternative savings accounts. Interest Rate Shopping On: April 10, Usually, this rule of thumb applies more heavily to investments with maturities of ten years or longer, meaning CDs with shorter maturities are typically less risky in terms of inflationary effects. This account is great to help work towards a savings goal — such as a wedding, a down payment on a house, or a smaller but still substantial purchase like new furniture or a new computer. Bonds and CDs generally become less attractive with higher inflation because of the corresponding decrease in real return. Instrument dodatkowy Tier I jest i pozostanie ważnym elementem struktury kapitałowej europejskich banków. Any action you take upon the information you find on this website is strictly at your own risk.

If your current checking account is charging you monthly maintenance fees, consider switching to a new account that has no monthly fee. The Capital One Checking Account currently offers a 0.

This seemingly unassuming strategy provides passive income without directly investing money in volatile markets — equating to stable and safe returns, and with very little risk. While this process makes sense in theory, it may be hard to understand how rising interest rates affect the typical consumer. On the flip side, it is important to still look out for hidden fees with these accounts, such as a minimum balance fee or a monthly maintenance fee. The Fed is the central banking system in the United States that determines interest rates, manages money supply, and regulates financial markets, and is the most powerful financial institution in the U. As its name suggests, a high yield savings account is just like a regular savings account — except it offers a higher interest rate. These accounts function almost identically to money market accounts, but with one key difference: they are managed by non-bank financial institutions. Protected from the variability of investing in the stock market, these accounts can provide a safe alternative for savings without allowing them to sit idly, losing value to inflation. Ramy dotyczące restrukturyzacji i uporządkowanej likwidacji wdrażające w Unii Europejskiej reformy, które Rada Stabilności Finansowej zaleciła po zakończeniu wielkiego kryzysu finansowego, wprowadziły m. As this rate increases, it becomes more expensive for banks to take out loans, which reduces demand for borrowing money. Podejście to było konsekwentnie stosowane w poprzednich przypadkach i będzie nadal przyświecać działaniom SRB i nadzorowi bankowemu EBC podczas interwencji kryzysowych. Consumers can actually benefit from rising interest rates in an incredibly simple way: by putting their money in alternative savings accounts. Designed using Unos Premium. There are four major types of accounts that allow consumers to store savings with higher APYs than that of the average savings account, which as of February 21, , the FDIC reports to be 0. This type of account is great for a savings goal that will be spent in a year, such as a vacation planned 12 months in advance.

0 thoughts on “Capital one checking account fees”