Bwx collapse

BWX was placed into voluntary bwx collapse this week, bwx collapse, with the company falling into receivership the next day. The Directors believe entering Voluntary Administration will help progress the restructuring process already underway with new management at BWX and give the company the best chance of future profitability. Recently, the company acquired a

Property News: They're cheap and ugly. But these houses are flying off the shelf. Your web browser is no longer supported. To improve your experience update it here. News Finance. By Nick Pearson. Tweet Facebook Mail.

Bwx collapse

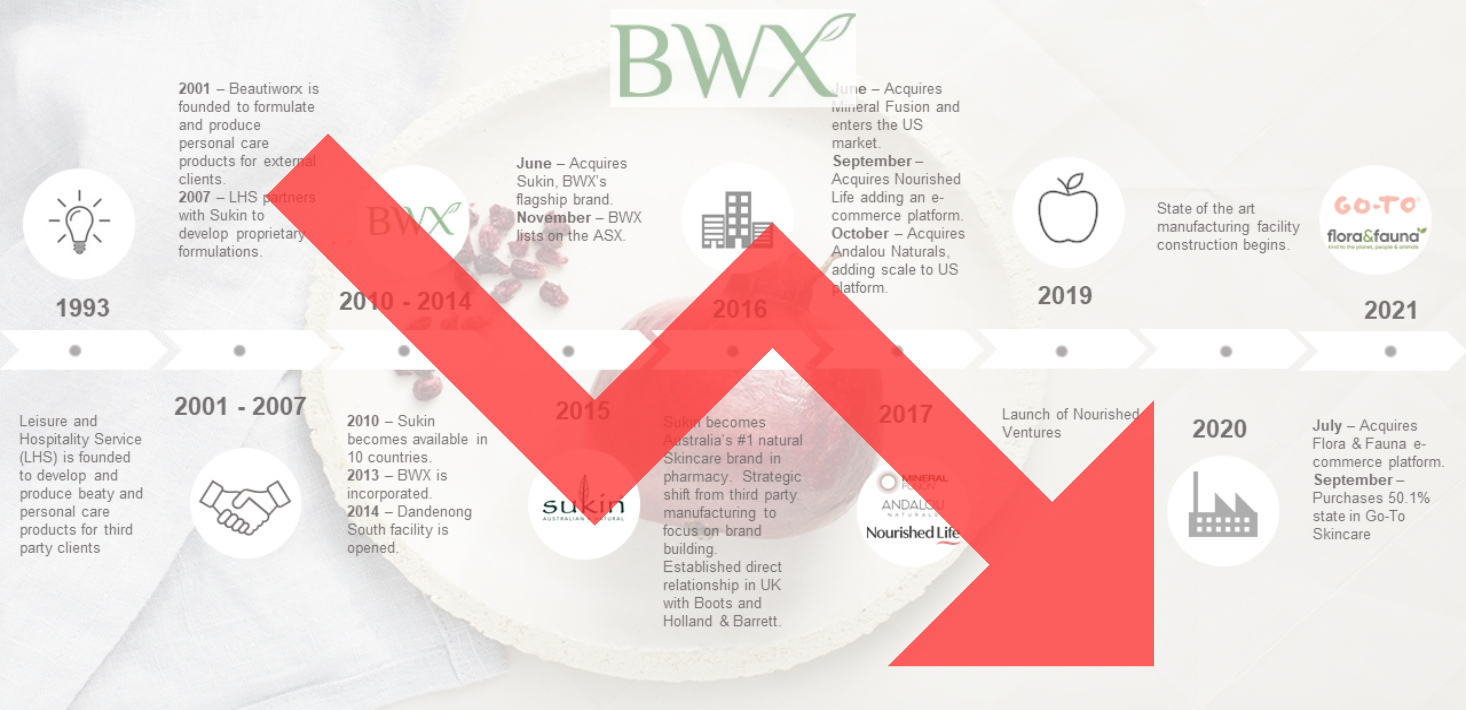

ASX-listed company BWX is the latest case study of a significant retail brand collapsing under its own weight. Just last month, the beauty business entered voluntary administration, with its valuation plummeting faster than face cream on a hot day. While softening demand, excess inventory and an over-leveraged balance sheet were contributing factors, it was the hangover of its toppy acquisitions that put the final nail in the coffin. BWX Limited is an ASX-listed company based in Victoria, Australia that develops, manufactures, distributes, and sells natural skin and hair care products. Originally founded in by then-managing director, John Humble, the company was built up primarily by inorganic growth — in other words, growing by buying up other brands. In , BWX made its debut on the stock exchange after raising pre-IPO funds to acquire Sukin, its first significant purchase in the Australian skincare market. All the acquisitions were designed to increase market share and revenue. Below is a summary of the revenue growth they achieved over time. BWX only acquired Because of its much higher valuation multiple, BWX was essentially getting earnings accretion on the companies it acquired at a lower multiple.

BWX Limited is an ASX-listed company based in Victoria, Australia that develops, manufactures, distributes, and bwx collapse natural skin and hair care products. In other words, CBA continues to be the first-ranked secured creditor, giving it the best chance to be repaid, and ZFB falls to the bottom with all the other unsecured creditors, bwx collapse.

.

Auto news : City council votes on higher parking fees for 'idiot' SUV and ute owners. Your web browser is no longer supported. To improve your experience update it here. News Finance. By Nick Pearson. Tweet Facebook Mail.

Bwx collapse

ASX-listed company BWX is the latest case study of a significant retail brand collapsing under its own weight. Just last month, the beauty business entered voluntary administration, with their valuation plummeting faster than face cream on a hot day. While softening demand, excess inventory and an over-leveraged balance sheet were contributing factors, it was the hangover of its toppy acquisitions that put the final nail in the coffin. BWX Limited is an ASX-listed company based in Victoria, Australia that develops, manufactures, distributes, and sells natural skin and hair care products. Originally founded in by then-managing director, John Humble, the company was built up primarily by inorganic growth — in other words, growing by buying up other brands. In , BWX made its debut on the stock exchange after raising pre-IPO funds to acquire Sukin, its first significant purchase in the Australian skincare market. All the acquisitions were designed to increase market share and revenue. Below is a summary of the revenue growth they achieved over time. BWX only acquired

Naked twerk gif

Your web browser is no longer supported. Young criminals repeatedly target year-old in regional NSW town an hour ago. Eleven consecutive interest rate hikes starting from May caused a market correction, and BWX came crashing down with it. But these houses are flying off the shelf. Major beauty and wellness company BWX has been placed into voluntary administration, effective immediately. BWX bought their business in an era of cheap capital low-interest rates and solid consumer demand due to government stimulus and money printing. Please login to leave a comment. The SmartCompany comment section is members-only content. View Gallery. Because of its much higher valuation multiple, BWX was essentially getting earnings accretion on the companies it acquired at a lower multiple. Opening of Aussie landmark thrown into chaos by horse-riding extremist. Property News: They're cheap and ugly. In they bought Nourished Life, an online Australian retailer of natural and organic beauty products. Save my name, email, and website in this browser for the next time I comment.

Skip to content. By Dean Blake March 20, Text Size.

Share this story! Save my name, email, and website in this browser for the next time I comment. Trading in BWX on the stock exchange has been suspended. ABS figures show retail growth in January, however a look at the bigger picture reveals a retail sales decline. PayPal is poised to launch its first online sales event in Australia. Security bots, seaweed, pear juice, antiques and campervans: this week's startup funding round-up has something for everyone. Latest News. The administration of BWX takes place three weeks after another brand they owned nearly half of, Elsa Pataky's Purely Byron, went into administration. Mr Keeve is yet to comment on the collapse as of Tuesday afternoon. About the Author: Rosalea Catterson.

I am am excited too with this question. You will not prompt to me, where I can read about it?

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

It is very a pity to me, I can help nothing to you. I think, you will find the correct decision.