Buy and hold tqqq

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

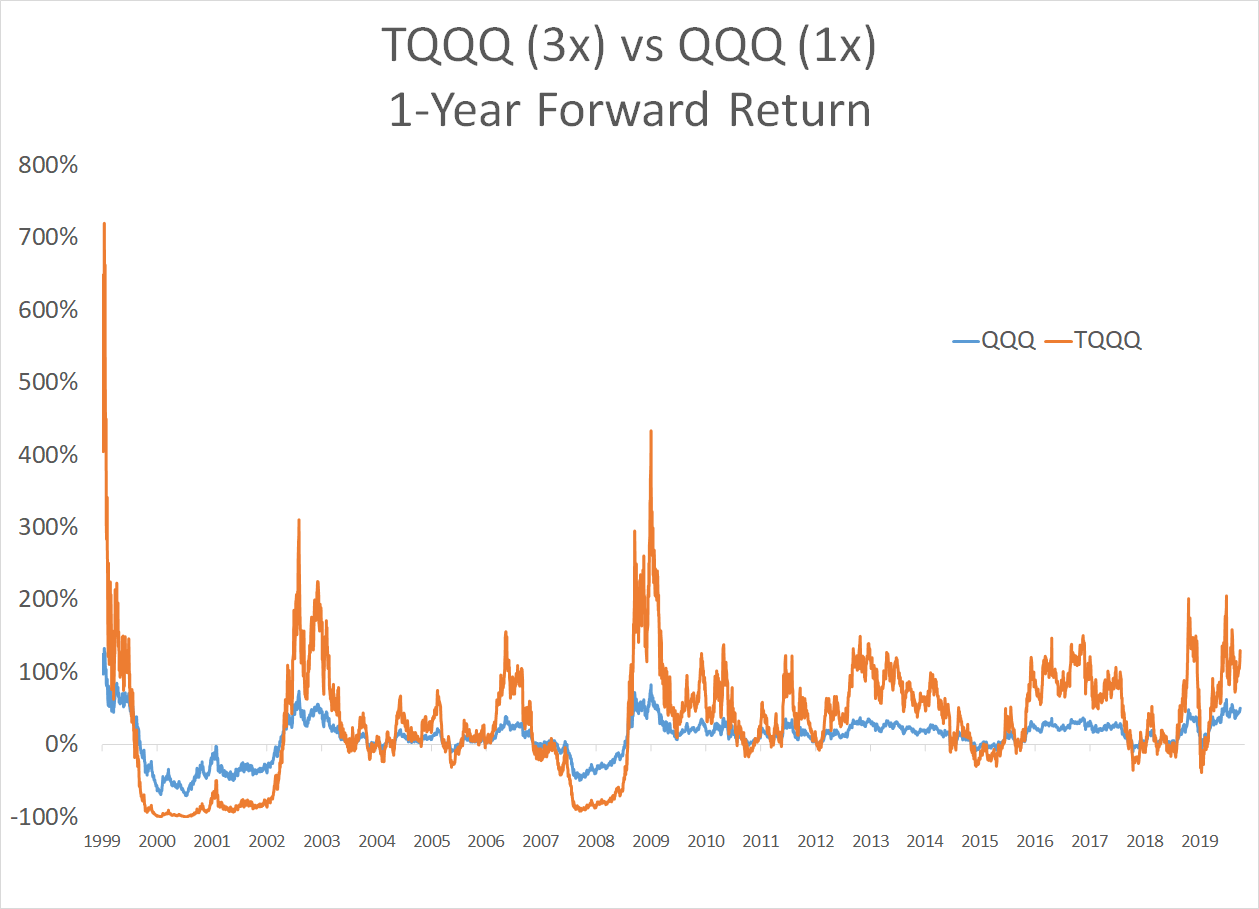

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love to hear some expert opinions on if TQQQ is in fact a wise long-term investment. The primary argument against it seems to be that 1. And 2. Something about the use of leverage and rebalancing of holdings creates decay, which in the long-run diminishes returns.

Buy and hold tqqq

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day. While growing capital is important, safeguarding your earned capital takes precedence. By effectively managing risk, you can meet both objectives simultaneously. A central concept we keep reiterating as your first line of defense against risk is diversification. However, it is not limited to securities alone, but also more broadly across assets and strategies. Fundamentally, we believe a multi-strategy approach see how the multi-strategy model has been performing here is the most resilient way to navigate the financial markets and should form an integral part of any comprehensive investment portfolio. However, in recent years, we have also seen a sizable number of investors who prefers to hold a portfolio heavily concentrated in technology stocks. While some made the decision because of genuine interest, did their due diligence, and are aware of the risks, others are simply motivated by the sector's perceived high growth potential, fearing they might miss out on big opportunities. Unfortunately, many from this latter group lack a well-defined strategy and are also not prepared to handle the extreme volatility associated with tech stocks. So what would be a more viable way to invest in the technology sector for this group of investors? For investors who are drawn to the potential of the technology sector, but want a more prudent approach than investing in individual stock names, one option is to consider buying into a liquid, low-cost ETF with a strong skew towards technology companies. QQQ tracks the Nasdaq which is a tech-heavy index that carries favorite names such as Apple, Nvidia, and Microsoft.

With these modifications, your risk is now moderated by not taking the full exposure you could have with TQQQ. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products, buy and hold tqqq. The ETF offers liquid, cost-efficient exposure to a tech-heavy basket of large-cap, innovative companies without burdening investors with stock-picking or the commitment of a technology-specific ETF.

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee.

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission.

Buy and hold tqqq

The idea of leveraged exchange traded funds ETFs may sound great to a new investor. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day. But some investors attracted by upside forget the risks that go along with using that leverage. Since leveraged ETFs are specially created financial products designed for speculators, individuals who buy or trade them without understanding how they work should be extra cautious, because many leveraged ETFs are not structured like ordinary ETFs. An ordinary ETF is a pooled mutual fund that owns an underlying basket of securities or other assets, most often common stocks. That basket trades under its own ticker symbol throughout the ordinary trading day, the same way shares of a company like Meta formerly Facebook or Amazon do. From time to time, the net asset value the value of the underlying securities may deviate from the market price, but on the whole, the performance should track the underlying index and equal that performance over long periods minus the expense ratio. Simple enough. With a leveraged ETF, however, the fund uses debt and derivatives to amplify the returns of the underlying index at a ratio of 2-to-1 or even 3-to-1, instead of 1-to-1 like a regular ETF.

Beach chair with canopy

Eum et consequatur ut quia voluptas nam voluptatem. Thanks for submitting! Here is a short summary of the results:. It is just simple math. So we need to go back further to get a better idea of how TQQQ performs through major stock market crashes, which we can do by simulating returns going back further than the fund's inception. These cookies do not store any personal information. QQQ tracks the widely followed Nasdaq Index, a benchmark that holds famed technology and internet stocks such as Apple Inc. Generate graph from spreadsheet or upload to PV as a custom data series. GOOG , among others. Investment Strategy. Vanguard Webull vs. I wrote a comprehensive review of M1 here. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned.

Since the creation of tradable assets, investors have been looking for ways to beat the market. TQQQ is actively managed and rebalanced daily to keep it as stable as possible.

You'll need to rebalance a strategy like this regularly, meaning getting allocations back into balance since these volatile assets may stray quickly from their target weights. Magnetar Capital But there are exceptions, like the challenges faced in , where the twin pressure of rising inflation and interest rates hammers almost everything. Listen, if I could find the other post of this last week I would copy my response but here's the brief of it. This compensation may impact how and where listings appear. In the short term, I'll reevaluate in January and probably build my position over 1Q22, and in the long term I'm just going to continue to shovel cash in. I know they are not ideal for pod shop, but which has highest re recruit potential. The Bottom Line. Maxime ut et nihil. I'm all in on it, been all in on it.

I consider, that you commit an error. I can defend the position.

You have hit the mark. It seems to me it is very good thought. Completely with you I will agree.

I can not take part now in discussion - it is very occupied. Very soon I will necessarily express the opinion.