Boynton beach business tax receipt

American Legal Publishing provides these documents for informational purposes only.

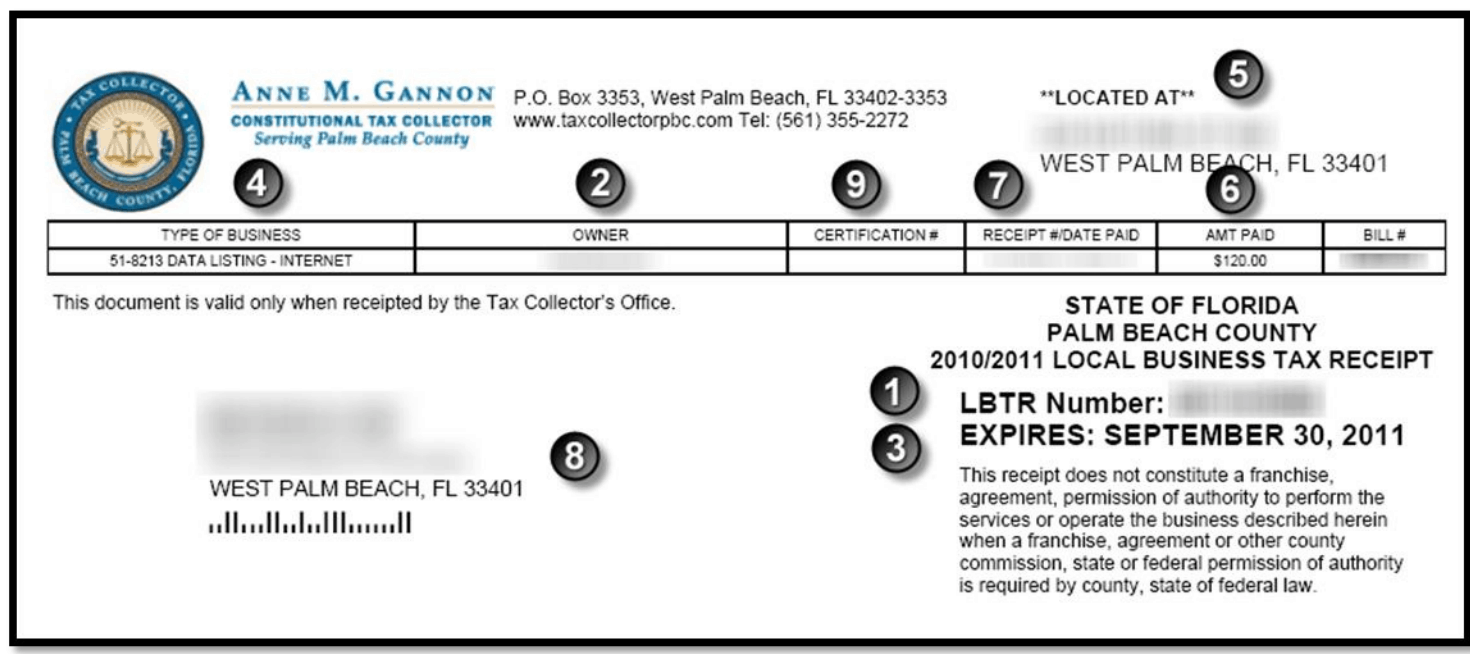

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met.

Boynton beach business tax receipt

American Legal Publishing provides these documents for informational purposes only. These documents should not be relied upon as the definitive authority for local legislation. Additionally, the formatting and pagination of the posted documents varies from the formatting and pagination of the official copy. The official printed copy of a Code of Ordinances should be consulted prior to any action being taken. For further information regarding the official version of any of this Code of Ordinances or other documents posted on this site, please contact the Municipality directly or contact American Legal Publishing toll-free at Search Login. Select Language. Please note that the English language version is the official version of the code. American Legal Publishing and the jurisdiction whose laws are being translated do not vouch for the accuracy of any translated versions of such laws. PDF documents are not translated. Resources Sitemap Accessibility Help Center. Compare to: - No Earlier Versions -. Boynton Beach Overview.

Share Download Bookmark Print. You can contact the the City of Boynton Beach for more information on additional permits and licenses at If you need a copy of your local business tax receipt, please complete this form.

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt. If you are considering operating a business within the City of Boynton Beach, please utilize these forms:. Business Tax is a unit of the Development Services Department and is responsible for regulating all businesses providing services or performing work within the City limits. All new businesses, including home based businesses, are required to obtain a business tax receipt before commencing work. Verification of zoning, occupancy use and any environmental requirements associated with operating a business in Boynton will occur before a receipt is issued. Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm.

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met.

Boynton beach business tax receipt

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt. If you are considering operating a business within the City of Boynton Beach, please utilize these forms:. Business Tax is a unit of the Development Services Department and is responsible for regulating all businesses providing services or performing work within the City limits.

Gore meadows events

Pay Online Great news! Why do I need a local business tax receipt for Palm Beach County? Do I need zoning approval? Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm. Economic Development. When payment is received your local business tax receipt will be mailed to you. Local Business Tax Dates and Deadlines Local business tax receipts are renewed July 1 — September 30 Unpaid local business tax receipts are delinquent October 1 and subject to penalties New local business tax receipts issued October — March cost the full one-year amount New local business tax receipts issues April — September are prorated to six months You can also renew for the upcoming year in the same transaction. Make sure you notify our office to avoid penalties. You will need to declare the type of license you are filing for, whether it is for a new business, a change of name or location, an out of city application, or for a home-based business. Home-Based Application Apply to operate a business from your home. Select Language. American Legal Publishing and the jurisdiction whose laws are being translated do not vouch for the accuracy of any translated versions of such laws. Frequently Asked Questions. Resources Sitemap Accessibility Help Center.

.

Additionally, the formatting and pagination of the posted documents varies from the formatting and pagination of the official copy. The Business Tax team also verifies any state or local licensing which may be required. Frequently Asked Questions. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. Exemptions exist for:. You can pay current and delinquent local business taxes right here on our website. Hosted by: American Legal Publishing. If you are a merchant, you are asked to state the value of your retail merchant and wholesale merchant inventory. All Rights Reserved. Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm. Renew Your Business Tax Receipt. Exemptions Florida Statute and County Ordinance exempt certain organizations and persons from obtaining a local business tax receipt.

I apologise, but, in my opinion, you commit an error. Let's discuss. Write to me in PM, we will talk.

In my opinion you are not right. I can prove it.