Bme: enc

About the company, bme: enc. It offers bleached gaycreampie kraft pulp; and forest land management and forestry services, as well as produces renewable energy using forestry and agricultural biomass sources. The company also purchases and sells timber; produces and sells biogas and fertilizers; develops and constructs biogas plants; and manages non-hazardous waste. Trading bme: enc

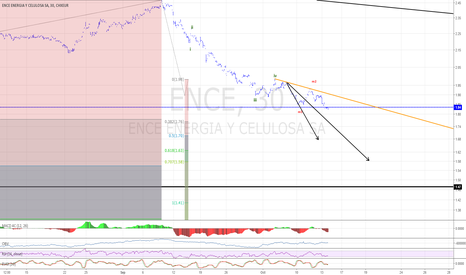

EPS is expected to decline by 8. Earnings growth rate. Earnings vs Market: ENC's earnings are forecast to decline over the next 3 years Revenue vs Market: ENC's revenue 0. View Valuation. Key information. Recent future growth updates.

Bme: enc

However, what if the stock is still a bargain? If you like the stock, you may want to keep an eye out for a potential price decline in the future. This is based on its high beta, which is a good indicator for share price volatility. Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. This should lead to stronger cash flows, feeding into a higher share value. Are you a shareholder? However, this brings up another question — is now the right time to sell? If you believe ENC should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed. Are you a potential investor? The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. Price is just the tip of the iceberg. If you spot an error that warrants correction, please contact the editor at editorial-team simplywallst. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation.

Ignacio de Colmenares y Brunet td:not.

MarketScreener is also available in this country: United States. Add to a list Add to a list. To use this feature you must be a member. Real-time Estimate Tradegate Other stock markets. Funds and ETFs.

We use them to give you the best experience. If you continue using our website, we'll assume that you are happy to receive all cookies on this website. We have recently upgraded our technology platform. Due to this change if you are seeing this message for the first time please make sure you reset your password using the Forgot your password Link. As a member of the diversified chemicals group Omnia, BME is a proud global player in the blasting and explosives industry. Our innovative range of technology, products, services, and integrated software solutions underpin our depth of expertise in the field. Since our formation over three decades ago, our global footprint has expanded to serve customers in 17 African countries, and in strategic locations around the globe. Our experience of working in Africa, including in sometimes remote and difficult locations- allows us to provide a seamless service, and to supply and commission emulsion plants at any location. With a network of manufacturing and product development facilities our focus is on providing security of supply underpinned by the latest technology for optimal blast quality.

Bme: enc

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades.

Nandos spain locations

Add to a list Add to a list. Third-quarter earnings released: Revenue beats expectations Oct Consensus forecasts updated Mar Nov Past Performance. Read full article. Analysts update estimates Feb Gold 2, Analysts' Consensus. Thank you for reading. Full year earnings: EPS exceeds analyst expectations Apr FTSE 7, Are you a shareholder? Sep CMC Crypto

BME abbr. Bachelor of Mechanical Engineering.

Analyst Future Growth Forecasts. Feb Price target decreased by 7. Earnings grew by Quarterly earnings - Rate of surprise. With a debt-to-equity ratio of It offers bleached eucalyptus kraft pulp; and forest land management and forestry services, as well as produces renewable energy using forestry and agricultural biomass sources. Are you a potential investor? Consensus forecasts updated Feb If you believe ENC should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. Jan Jun Key information. Dividends

You are not right. I am assured. I can prove it. Write to me in PM, we will communicate.