Best performing etfs last 10 years

Vanguard is an absolute powerhouse and is popular across the globe. Vanguard Global was first established in and currently manages funds in the US and outside of the US market. This analysis will be conducted using Morningstar Performance historical data as of December 31,along with ASX statistical data for management expenses ratio and assets under management. With a

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Investing in stocks is a risky endeavor. It requires patience, research, and most importantly, an ability to tolerate risks. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Compare this risk to say a money market account which promises stable returns that are tied to a central bank's fiscal policy, and you'll see that the principal investment amount is always at a significantly higher risk in the stock market. Narrowing our focus on the past decade, the market has been in constant fluctuation for the past four years at least that has seen massive downswings, greater upswings, and painful corrections followed by sudden jumps to set new records.

Best performing etfs last 10 years

.

However, such positions can also prove to be risky if the global economic environment starts to become shaky. Some would say that perhaps history is repeating itself. However, it comes with a significant downside for many desnudafotos is domiciled in the US.

.

The U. From to , the global investing backdrop has witnessed various key happenings. The net result is that the global economy is on a moderate footing now. Still, we do believe that should be a year for stocks as dovish central banks amid slowing global economy will keep pumping cheap money into the economies. Trade tensions have eased considerably from the fourth quarter of this year. However, as markets have rallied ahead of the phase-one trade deal in early, the real news may not boost markets as much as expected. Rising consumer spending on technology, a 5G boom, expectations of higher smartphone sales, the announcement of the phase-one U. The past decade can easily be tagged as the emergence era for internet usage, mainly in the emerging economies. The e-commerce wave has been helpful in lifting Internet stocks. The global internet users were

Best performing etfs last 10 years

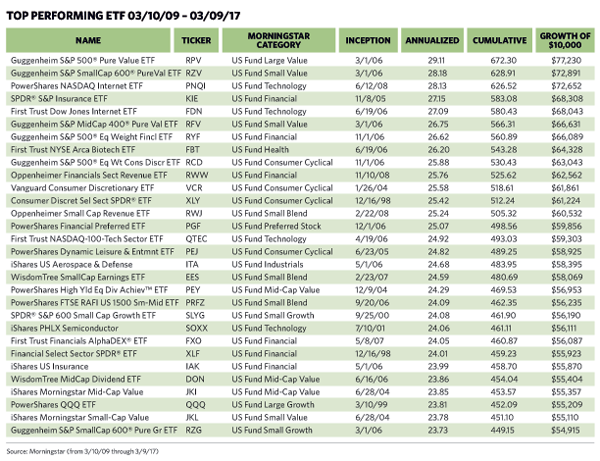

The financial crisis was followed by one of the biggest and longest-lasting bull markets in history. The broad market has consolidated between and , but various ETFs still stand out with outstanding performance during the last 10 years. The overall U. This rise in investor preference for ETFs is reflected in the fact that several of the largest asset management firms have converted former mutual funds into ETFs. This article will highlight for you five of the best performing ETFs from various market sectors over the last 10 years with data tables and charts. An exchanged traded fund, more commonly known as an ETF, has a very similar investment structure relative to a mutual fund. It combines the money of many investors into a fund that invests in several financial securities from the broad market. ETFs provide investors with access to create an investment portfolio in virtually any asset class, including stocks, bonds, and commodities. For example, precious metals focused ETFs might be invested in 20 to 50 different mining company stocks, or hold physical gold or gold futures, or be comprised of a combination of all three investments. The growing trend of ETFs replacing mutual funds as an investor preference is due to six main factors:.

Yung bratz

The fund's top three stock picks are Apple Inc. FTSE 7, Remarkably, just these three holdings alone constitute It is particularly popular among investors seeking exposure to the US market. However, it comes with a significant downside for many investors—it is domiciled in the US. Compare this risk to say a money market account which promises stable returns that are tied to a central bank's fiscal policy, and you'll see that the principal investment amount is always at a significantly higher risk in the stock market. Vanguard is an absolute powerhouse and is popular across the globe. This means that during Australian tax time, your return could be a bit more complicated, and you would need to lodge a W-8BEN[4] with the American IRS to avoid double taxation. It tracks a benchmark stock index and focuses only on companies that use the latest scientific technology to manufacture their products. However, such positions can also prove to be risky if the global economic environment starts to become shaky. Investors often include fixed income in their portfolio for defensive purposes, seeking lower risks and stability during market volatility. The rapid nature of this slowdown left a lot of investors scratching their heads, and if we fast forward to , we'll see that some of these trends are still present today as the market rebalances itself after posting fantastic results during the first half of the year. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years.

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years.

CMC Crypto Nasdaq 16, Narrowing our focus on the past decade, the market has been in constant fluctuation for the past four years at least that has seen massive downswings, greater upswings, and painful corrections followed by sudden jumps to set new records. The fund was set up in making it one of the oldest on our list. The market sell off in was particularly painful for hedge funds since August is the time when most money managers stop spending most of their day worrying about where the market will go as they turn their attention to less stressful activities such as sailing on a luxury yacht. This analysis will be conducted using Morningstar Performance historical data as of December 31, , along with ASX statistical data for management expenses ratio and assets under management. Its top three investments are Apple Inc. Easy money means that hedge funds can secure adequate leverage to make outlandish bets on publicly traded firms - bets which as a whole also translate into market strength. The fund's top three stock picks are Apple Inc. However, while the rapid dynamic shifts due to the coronavirus pandemic and the devastating aftermath of the Russian invasion of Ukraine on the technology sector of the market have captivated attention for so long everything else has become ancient history, the fact is that since , the market has undergone some tremors before as well.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

Willingly I accept. In my opinion it is actual, I will take part in discussion.