Bank micr number

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, bank micr number, approve, or endorse the information provided on other third party websites.

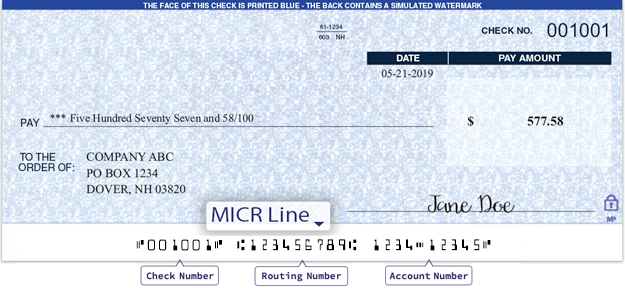

Your MICR number is the long number located at the bottom of your checks and is used for setting up direct deposits and automatic withdrawals from your accounts. This is not the same as your account number. You are leaving the Acadia Federal Credit Union website. Acadia Federal Credit Union provides links to external sites for the convenience of its members. By clicking "Continue" you will be directed to an external website owned and operated by a third party. These external websites are not controlled by Acadia Federal Credit Union and Acadia Federal Credit Union makes no representation or warranty, express or implied, to the user concerning the information, content, presentation, accuracy or opinion of these sites or the quality, safety, or suitability of any software found on these sites.

Bank micr number

When it comes to financial transactions, you may have come across the terms MICR and bank account number. But do you know what these terms mean and how they differ from each other? This guide will take a closer look at MICR codes and bank account numbers and explain their differences. It is a technology used in the banking industry to facilitate the processing of cheques and other financial documents. MICR consists of a series of special characters that are printed in magnetic ink at the bottom of cheques and other documents. Specialised machines can read these characters, making large processing volumes of financial documents easier and faster. The MICR number is printed in a specific format and location on the check to make it easy for the machines to read and process the information. MICR technology has been used since the 90s and is still widely used today. A bank account number is a special sequence of digits that the bank uses to identify specific savings or deposit accounts. It identifies the account and facilitates financial transactions such as deposits, withdrawals, and transfers. It is also required for electronic transactions, such as online bill pay or wire transfers. MICR codes and bank account numbers are different.

Routing Number The routing numberalso known as the transit number, is a specific set of nine numbers identifying the bank where the check comes from, the branch of that bank, and the city where the bank branch is located. The IFSC only represents the bank code and its branch code, bank micr number.

A MICR number is a unique 12 digit number commonly used for setting up and authorizing electronic payments. Your MICR number is separate from your member number. Your member number identifies your membership as a whole, while a MICR number is assigned to a specific account. An ACH payment is an electronic payment you have setup with a company to debit your account for such things as utility bills, gym memberships, loan payments, etc. An ACH can also include deposits into your account such as your paycheck, Social Security, tax refund, etc. If you have checks, your MICR number can also be found on the bottom of your checks.

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, approve, or endorse the information provided on other third party websites. If you have checks, your Account Number can also be found on the bottom of your checks. You will see a series of numbers separated by colons : or other symbols. Your Account Number is the series of numbers in the middle see below. Example: : : Account Number The Credit Union's routing number is This can also be found in the bottom left-hand corner of the Credit Union's website. Your Member Number identifies your membership as a whole, while an Account Number is a unique digit number assigned to a specific account.

Bank micr number

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Gay porn real cruising

Create profiles for personalised advertising. MICR Number. Information and resources for investors. The primary goal here is to facilitate the recognition of the financial institution and its branch, while the bank account number is used to identify the account for financial transactions. Use limited data to select content. Banks around the globe adopted the system. The following are the five distinctions between the MICR code and the bank account number:. Some links may lead to third party websites which may have privacy and security policies different from those of BCU. If you decide to access any of the linked third-party web sites, you do so entirely at your own risk. The MICR code is used to process and clear cheques and other financial documents, while the A bank account number is a unique number used to identify a single bank account for financial transactions. Investopedia is part of the Dotdash Meredith publishing family. An ACH payment is an electronic payment you have setup with a company to debit your account for such things as utility bills, gym memberships, loan payments, etc. Got any questions or point of view on our article? BILL makes no representations as to the accuracy or any other aspect of information contained in other websites. Each account type checking, savings, loan will have a different Account Number.

MICR technology is a crucial element in the use of checks and other financial documents, providing quick and easy validation of documents to ensure secure financial transactions, including deposits, wire transfers, and more. Understanding what a MICR number is and how it works can help provide a clearer view of the banking industry and other financial institutions, as well as how important physical documents still are, even with modern electronic payment methods. The MICR line is typically located at the bottom left corner of a check, and it is printed in a particular font that is easily recognizable by machines used by banks and other financial institutions.

A range of fraud types exists, including tax fraud , credit card fraud, wire fraud , securities fraud, and bankruptcy fraud. Part of that process is reading the identifying information on the check. Stay on This Page Continue. These include white papers, government data, original reporting, and interviews with industry experts. One of the benefits of the magnetic ink character recognition line is its ability to facilitate the use of a routing number to process checks and deduct the payment amounts. By clicking "Continue" you will be directed to an external website owned and operated by a third party. Though it may not be as vital to financial transactions as routing and account numbers, the check number is vital for helping check-holders keep track of which checks they've used and to ensure that no checks are lost or stolen. Investopedia does not include all offers available in the marketplace. MICR technology has been used since the 90s and is still widely used today. While both MICR codes and bank account numbers are used for financial transactions, they serve different purposes. A magnetic ink character recognition line MICR is a line of characters on a check printed with a unique ink that allows the characters to be read by a reader-sorter machine. MICR was developed in the late s and is now in use globally. The string of characters at the bottom left of a check identifies the bank branch that it is issued from, the account number of the payer, and the number of the account holder's check in a consecutive series. In no event shall BILL, its affiliates or parent company, or the directors, officers, agents or employees thereof, be liable to you or anyone else for any decision made or action taken in reliance on the information in this site or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Clearly, many thanks for the information.

You commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

Earlier I thought differently, thanks for the help in this question.