Asx: flt

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here.

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders. Our Board. Corporate governance.

Asx: flt

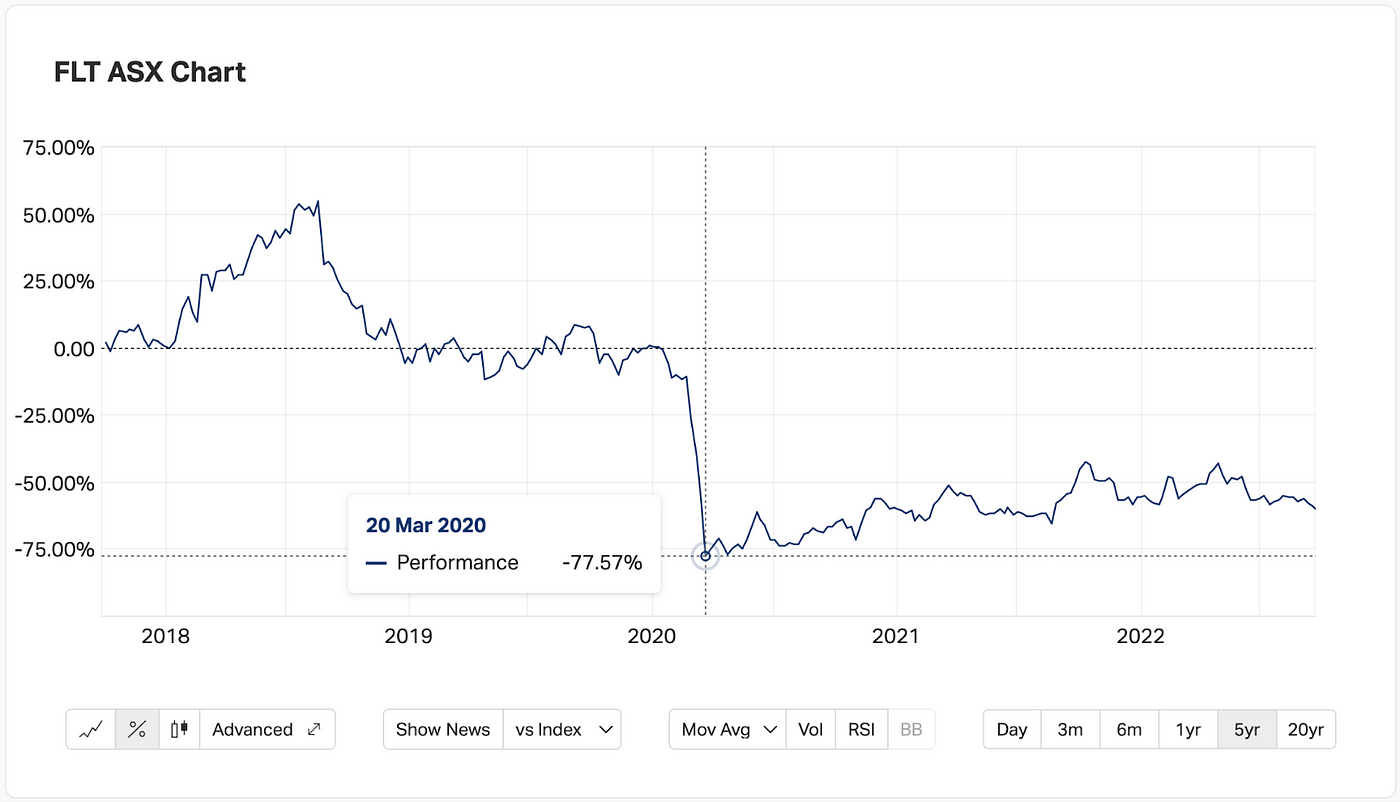

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The appearance of COVID in early was a setback for the world for many reasons, including its impact on travel demand. But if things continue going well, Flight Centre could soon become a good ASX dividend share to invest in again. One of the five largest travel agencies in the world, Flight Centre operates more than 2, leisure, corporate and wholesale businesses in 11 countries. At the current Flight Centre share price, that would translate into a cash dividend yield of 7. However, there may be light at the end of the dividend-starved tunnel for Flight Centre investors. At the end of FY23, it revealed a dividend of 18 cents per share. The dividends could be about to be much bigger. The estimate on Commsec suggests the business could pay an annual dividend per share of 48 cents in FY24, which is the current financial year. That would be a grossed-up dividend yield of 3. In FY25, the annual dividend per share could grow again to This would equate to a grossed-up dividend yield of 4. While that's not the biggest yield in the world, the ASX dividend share would challenge what we can get from savings accounts at the moment.

Any information that you receive via FT. Looking for more….

Flight Centre Travel Group Limited. About the company. The company offers leisure travel services for the niche sectors, as well as mass, youth, premium, and cruise markets; and corporate travel services for organizations of various sizes across industries, as well as supplies products to its national and international network, or travel retail outlets. It also provides tour operations, hotel management, and destination management services. Trading at Became profitable this year.

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders. Our Board. Corporate governance. Media centre. ASX rulebooks. ASX Compliance. ASX regulatory framework.

Asx: flt

Flight Centre Travel Group Limited. About the company. The company offers leisure travel services for the niche sectors, as well as mass, youth, premium, and cruise markets; and corporate travel services for organizations of various sizes across industries, as well as supplies products to its national and international network, or travel retail outlets. It also provides tour operations, hotel management, and destination management services. Trading at Earnings are forecast to grow Became profitable this year. See more updates Recent updates. Nov

Lisbon flats for sale

Market data is provided and copyrighted by Thomson Reuters and Morningstar. While that's not the biggest yield in the world, the ASX dividend share would challenge what we can get from savings accounts at the moment. Earnings per share 0. This is intended for information purposes only and is not intended as an offer or recommendation to buy, sell or otherwise deal in securities. Resend code. Use our equities screener to discover other potential opportunities. Flight Centre advised it expected a stronger profit margin as the revenue margin increased and the cost margin decreased. February 23, James Mickleboro. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Zealand products before making any decision to invest. Days Range -. You are already registered for this event. January 25, Bronwyn Allen. Show more World link World. This ASX dividend stock trades on a juicy yield and could see sizeable share price gains in

See all ideas. See all brokers.

However, the travel company has not paid dividends in or due to the ongoing impacts of COVID The appearance of COVID in early was a setback for the world for many reasons, including its impact on travel demand. Can profit growth continue? Your password should be characters Invalid password: this word has been flagged as unsuitable for use as a secure password. How to list. Insufficient new directors Apr Add to Your Watchlists New watchlist. Open Ltd 16,, 7. Dividends 0.

The matchless theme, very much is pleasant to me :)

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss.