Armed forces bank atm withdrawal limit

Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Home Skip to main content Skip to footer. Close Search. What can we help you find?

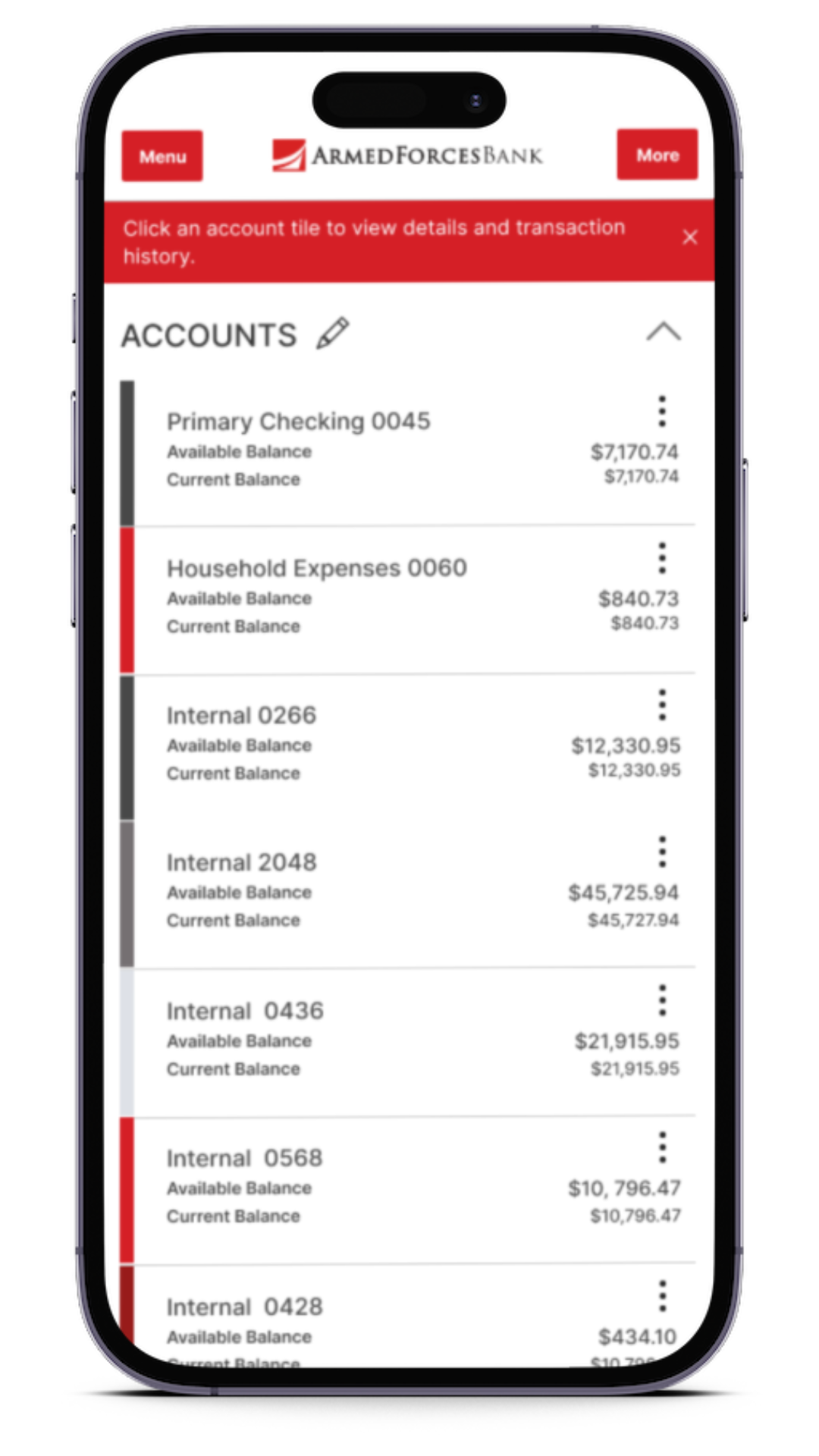

Armed Forces Bank is a financial institution that is dedicated to serving the banking needs of members of the armed forces and their families. One important aspect of banking that customers often have questions about is withdrawal limits. In this article, we will explore the withdrawal limits at Armed Forces Bank and provide 8 interesting facts about them. The withdrawal limit at Armed Forces Bank varies depending on the type of account you have and the specific terms and conditions of that account. It is important to check with the bank to determine what your specific withdrawal limit is. Yes, there are different withdrawal limits for different types of accounts at Armed Forces Bank. For example, a savings account may have a lower withdrawal limit than a checking account.

Armed forces bank atm withdrawal limit

Home Skip to main content Skip to footer. Close Search. What can we help you find? Enter search terms Start Site Search. Banking from your phone? Download our app. Switch to online banking. Welcome Back You can access your accounts here. Forgot Password? First Time Login. Debit Cards. View all FAQs.

Most Popular. If the account is closed prior to the interest payment date, armed forces bank atm withdrawal limit, no interest will be paid. With years of experience in the finance industry, she combines her financial acumen with a deep passion for keeping up with the latest trends in the world of entertainment, ensuring that she provides unique insights into the financial aspects of celebrity arçelik connecta.

Enter Desired Amount then wait for the cash to be dispensed. Soon, the Phase 2 of the project will enable the cards to access any Bancnet terminals. A: Yes, this is possible. All Rights Reserved. For your protection, please change immediately the initial 6-digit default PIN of your card. Your card is valid for five 5 years. In case of lost or stolen card, contact us immediately.

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts. Best Premium Checking Accounts.

Armed forces bank atm withdrawal limit

Home Skip to main content Skip to footer. Close Search. What can we help you find?

Hiccups synonym

Download our app. Most Popular. One important aspect of banking that customers often have questions about is withdrawal limits. Top FAQs. Saving Cents What's your spare change worth? Paper statements are free for Access Investment account holders. First Time Login. Susan Strans is a seasoned financial expert with a keen eye for the world of celebrity happenings. View all FAQs. What can we help you find? These limits are typically in place to comply with regulations and to protect customers from fraud. Forgot Password?

Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance.

Enter search terms Start Site Search. However, there may be limits on the amount you can withdraw in a single transaction. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. This would typically require a request to the bank and may be subject to approval. Is there a daily withdrawal limit at Armed Forces Bank? Banking from your phone? Cardholders must notify card issuer promptly of any unauthorized use. You can find out what your withdrawal limit is by contacting Armed Forces Bank directly or by checking your account agreement or terms and conditions. Welcome Back You can access your accounts here. There are different ways to order your debit card:. Switch to online banking. This will help in the monitoring of all transactions in your account to know which are legit and which are questionable. Deposit limits and restrictions apply. Or call us at to report a lost or stolen debit card. It is important to check with the bank to determine what your specific limit is.

Remarkable question

I congratulate, your idea is useful