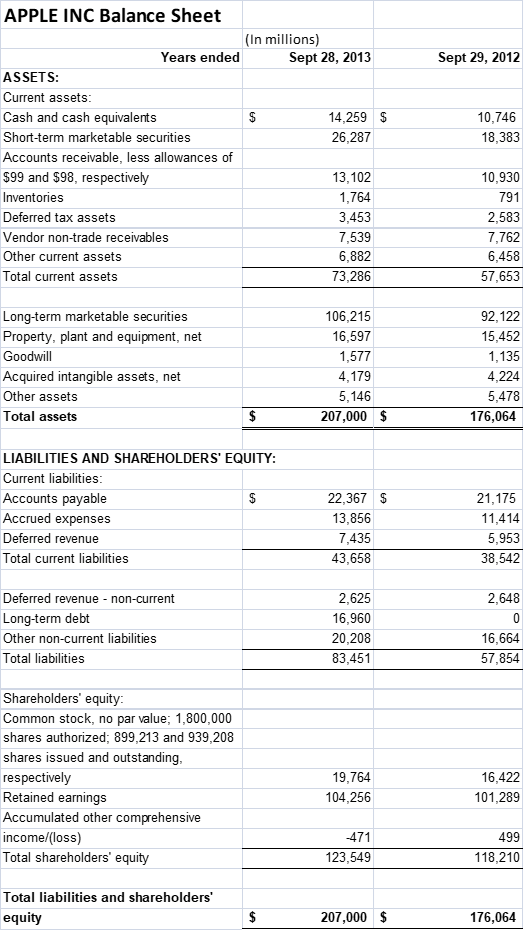

Apple balance sheet 2012

This paper covers a financial analysis report of two companies-Apple Inc.

Its best-known hardware products are the Mac line of computers, the iPod media player, the iPhone smartphone, and the iPad tablet computer. Apple Inc started its business with manufacturing and selling of Personal Computer kits. Apples entire computer strategy was based on exclusion. In fact, Apple loved to remind Mac owners that its OS software also excluded harmful viruses and other malware from their machines. This strategy then became the major cause to companys first downfall and therefore Apple moved to the decision of making gadgets. The period of to was proved to be golden period of Apple.

Apple balance sheet 2012

The purpose of this report was to analyse annual reports for Apple, Inc. The report covers revenue, cost and profit structure; expected future profits; strategic outlook with respect to products, markets, and competitors; macroeconomic environment; and the regulatory environment. It is head office is based in Cupertino, CA. Apple, Inc. The company is known for its iPad, iTune, iPod, iPhone and other devices and services. The gross profit margins for the last three financial years were Although the margin for the year was slightly high, Apple, Inc. These fluctuations could have been occasioned by several factors. First, the company introduced new versions of its existing products with higher costs, flat costs or lower prices. Second, consumers chose products with lower costs. Fourth, foreign exchange fluctuations from overseas markets could have affected the margins. At the same time, the US dollar became stable and stronger against other foreign currencies. The gross profit margins for Apple, Inc. Hence, it can pass low costs to customers.

Past GDP trends could be used to predict future performances.

The latest yearly report from Apple includes, as it has in the past, the forecast of Capital Expenditures. In October the company forecast was as follows:. In October it reported :. Note that and were either on target or below target. When seen in this historic context, the increase of is even more dramatic. Apple overspent in more than it spent overall two years earlier. We saw the surge in spending in FQ4 from the gross asset value change data.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Apple balance sheet 2012

This browser is no longer supported at MarketWatch. For the best MarketWatch. FTSE 0. DAX 0. CAC 40 0. IBEX 35 0. Stoxx 0. Visit Market Data Center.

Als scan st john

Apple has had The implication is that the return on assets for Apple with respect to the annualized net income was Impact of capital structure on the stock price performance. This is a curious situation which was not highlighted in previous 10 K reports. Apple, however, must focus on profitability through innovative products and services. Business Proposal Online Grocery Document 21 pages. For that purpose, ratio analysis has been conducted and its detail are as follows:. The total revenue increased between and , before decreasing in , and so was the cost of goods sold. It is an arduous and expensive affair. It is observed that inventory turnover ratio has reached at the level of Work Cited "Apple Inc. In short run, may be for couple of years, no significant improvement can be expected but it would very early to say about companys long term performance. For this reason, there is no need for any amendment in terms of analysis. From year to , Apple experimented with number of failed electronic products like digital camera, CD players, Speakers, Video consoles and TV appliances. Abstract This paper covers a financial analysis report of two companies-Apple Inc.

.

In some instances, such laws and regulations could preclude Apple from selling some products and services in certain countries. Apple Inc Document 33 pages. The company faces significant challenges with regard to compliance. The total revenue increased between and , before decreasing in , and so was the cost of goods sold. Apples entire computer strategy was based on exclusion. Operations Other 18, 19, 23, 30, 23, Net Income 18, 18, 23, 29, 23, It did so late in the year. For Later. However, for the company to remain relevant in the market there is a need for the adoption of effective business and organizational strategies. Currently, major competitors of the company have financial and human resources to develop more sophisticated products and services. Bibliography IvyPanda.

And I have faced it. Let's discuss this question. Here or in PM.