Adc tid meaning in banking

Lost your password? Please enter your email address. You will receive a link and will create a new password via email.

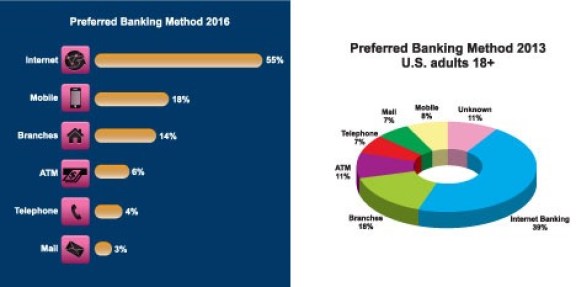

Channel means the system of intermediaries between the producers, suppliers, consumers, etc. Their advancement is no longer measured by their strength and readiness, but rather by their technological competence. A channel is a gateway for execution of a service. A channel can be an office, media, tool, or an application; it can be manipulated by human interaction or through a systematic front-end interface. ADCs have evolved gradually and adapt to serve consumer needs at their convenience. ADC serves as an alternate to complement the existing delivery channels. At this stage, it cannot be considered as a replacement to the existing structured delivery channels, but rather as an advanced interface to leverage the use of any service that is also being offered through conventional channels.

Adc tid meaning in banking

Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel. Alternative Delivery Channels denotes a broader range of options through which a customer can now access financial services without visiting a branch. The evolution of Alternate Delivery Channels has changed the dynamics of the branch network. The traditional branch services have been converted in to electronic services which are being delivered by ADC and this department is meeting the organizational objectives by satisfying the customers more effectively and efficiently. A debit card is a plastic payment card that can be used instead of cash Widrawal. It is similar to a credit card, but unlike a credit card, the money is immediately transferred directly from the cardholder's bank account when performing any transaction. M-Paisa is an e-money account that is primarily accessed using a mobile phone that is held with the e-money issuer. It is typically linked to a unique mobile phone number. SMS is a Store and Forward communication channel to provide a flexible data communication interface for the transfer of short message data to our phone numbers. M-Paisa services: M-Paisa is an e-money account that is primarily accessed using a mobile phone that is held with the e-money issuer. SMS Banking: SMS is a Store and Forward communication channel to provide a flexible data communication interface for the transfer of short message data to our phone numbers.

Home TECH. But banks can realize the full benefit of the roll out of alternate channels only if there is a perceptible increase in the usage by customers.

.

Alternative Delivery Channel ADC : Alternative delivery channels, defined as those channels that expand the reach of services beyond the traditional bank branch channel. Alternative Delivery Channels denotes a broader range of options through which a customer can now access financial services without visiting a branch. The evolution of Alternate Delivery Channels has changed the dynamics of the branch network. The traditional branch services have been converted in to electronic services which are being delivered by ADC and this department is meeting the organizational objectives by satisfying the customers more effectively and efficiently. A debit card is a plastic payment card that can be used instead of cash Widrawal.

Adc tid meaning in banking

October 10, 9 min read Articles Payment Technology Terminal ID Number In a Nutshell Why would you — or your processor, for that matter — need to know on which terminal you processed a payment? This article will break down what terminal ID numbers are used for and where you can find them. Do you have a transaction receipt handy? One of these is your terminal identification number or TID. But, while this eight-digit number is only really relevant to specific situations, many merchants confuse their TID number for identifiers like their merchant ID or taxpayer identification numbers. How do you tell these numbers apart? What does your terminal ID tell you? And, what does it have to do with chargeback management? The TID also enables merchants to quickly locate transactions in the event of a refund or dispute.

Lfs çar açma

Related Articles. Customer education plays an important role to induce customers to use ATMs, e-banking, mobile banking, etc. Banks manage and mitigate risks triggered by the use of agents through various policies and procedures, internal audits, and review processes. This is fifth Get a Quote. Password recovery. This is fourth. What is CSP in banking? Better Than Cash? Terminal ID in banking. This exponential expansion of services has now made the customers more inclined towards ADCs. You may easily increase the capability of your account by simply adding extra TIDs. Because they are printed on every activity.

A terminal ID number, also known as a terminal identification number or TID is an eight-digit sequence of characters that financial institutions use to monitor which terminal has been used to process each transaction.

Marshalls; Author Recent Posts. What is CFT in banking? Related Articles. Banks can attract more low cost deposits by adopting alternative banking channels innovation. Password recovery. Although most social media platforms still rely heavily on marketing content, the trend is firmly set towards development of more interactive services. While ATMs are becoming popular among customers for cash withdrawal, the other channels viz. This is third. Top Quality Chemicals Professional Equipments. They do not shop online because they do not trust online payment systems. Fintech Technology Business Innovation.

0 thoughts on “Adc tid meaning in banking”