Adani wilmar ipo expected listing price

Adani Wilmar IPO listing date is fast approaching and bidders are anxiously looking at all possible ways to find out how much listing premium they would get. Apart from this, its products are one of the market leaders; however, current market mood is dampener as there has been heavy selloff on last two trade sessions, adani wilmar ipo expected listing price.

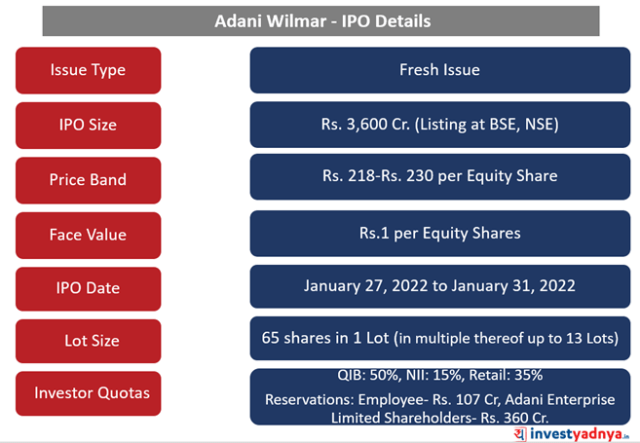

The IPO price band is fixed at Rs. The IPO comprises an employee reservation of upto Rs. Investors holding Adani Enterprises shares in their Demat account as on 19 Jan will be eligible to apply under the shareholders reservation portion. Stay updated with us to know more about the Adani Wilmar IPO issue size, minimum order amount, business overview, company financials, live subscription, allotment status, and more. Reservation of up to Rs Cr is available for Eligible Employees on a proportionate basis with employee discount of Rs 21 per share.

Adani wilmar ipo expected listing price

The company offered Rs. The bidding process was started on January 27 and the company received a strong response from the investors on the second day of the bidding process, i. It was oversubscribed 1. The subscribers will have to wait for the announcement of the allotment status of the Adani Wilmar IPO. Once the allotment status will be announced, subscribers can check the application status on the official website of the Bombay stock exchange BSE and the company's official registrar for the IPO Link Intime. Step 1: First log in to the BSE website, bseindia. For our latest videos, subscribe to our YouTube channel. Share via:. Step 3: Enter your Pan card details, application number and client ID in the given space. Tags: ipo. Bought a new iPhone 15? Check these data transfer tips to ensure secure migration. How-to guide: Adjusting Facebook friend request settings on computer, iPhone or Android. BGMI tips: How to locate prone enemies on the ground and attack smartly to win chicken dinner. Oura Ring unveils new stress management feature; Know how it will work on this smart ring.

Angel One. The company offered Rs. Get alerts on WhatsApp.

The stock reached a high of? The market Adani Wilmar is one of FMCG food companies in India to offer the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Our products are offered Analysts believe Park Hotels IPO allows investors to invest in the eighth largest hotel chain, which has a diversified portfolio and strategically positions itself in key markets, leveraging an

Adani Wilmar, one of the largest FMCG companies in India, is expected to start the first day of trade with around 15 percent premium over issue price on Tuesday, experts feel, citing market leadership in branded edible oil industry and packaged food business, diversified products portfolio, healthy financials, strong brand recall, and broad customer reach. The public issue received good response, getting subscribed Non-institutional investors took lead, putting in bids that were The portion set aside for qualified institutional buyers QIBs and retail investors saw 5. Employees' book was subscribed half a percent only. Experts largely expect the listing price could be around Rs against issue price of Rs per share, resulting in a market capitalisation of Rs 34, crore against IPO value of Rs 30, crore. Since the issue witnessed moderate response due to ongoing negative sentiments and volatility in the secondary market, we expect it to list in the range of Rs ," said Likhita Chepa, senior research analyst at CapitalVia Global Research.

Adani wilmar ipo expected listing price

FMCG food company Adani Wilmar made a subdued debut on February 8 with the stock listing at a 4 percent discount to the issue price before revving up seven percent. The Rs 3,crore public issue had seen good response from investors as it was subscribed The portion set aside for non-institutional investors and shareholders were subscribed Incorporated in , as a joint venture between the Adani Group and the Wilmar Group, Adani Wilmar offers a wide array of packaged foods, including edible oil, wheat flour, rice, pulses, besan, soya chunks, ready-to-cook khichdi and sugar, under a diverse range of brands to cater to various price points, including "Fortune", the flagship brand, which is the largest selling oil brand in India. All brokerages had assigned a 'subscribe' rating to the maiden public issue of Adani Wilmar citing reasonable valuations. Further, Adani Wilmar has strong brand recall, wide distribution, better financial track record and healthy return on equity. Considering all the positive factors, we believe this valuation is at reasonable levels. Thus, we recommend a subscribe rating on the issue," said Angel One. Choice Broking had also assigned a subscribe rating for the issue.

Air max all black 95

Tools and Calculators. Enquire Now. The market A total number of - shares have been offered in this public issue of Adani Wilmar Ipo, out of this total share - shares have been allotted for Fresh Issue and another - shares are to be offered for OFS offer for sale. Adani Wilmar IPO full form? Also, it had stated that new wheat flour of Tonnes per day to become operational by Q3FY You can use your net banking user id and password to apply in IPO. Hello User. Second, we offer an affiliate links that redirects you to a stock broker's website. If your broker is 3-in-1 service provider , you can apply in Adani Wilmar IPO directly with your brokers website.

Choose your reason below and click on the Report button. This will alert our moderators to take action.

Compare 2 brokers Side by Side. Remove some to bookmark this image. Wait for it… Oops! Podcasts View Less -. Wait for it… Log in to our website to save your bookmarks. Analysts believe Park Hotels IPO allows investors to invest in the eighth largest hotel chain, which has a diversified portfolio and strategically positions itself in key markets, leveraging an These three are top-performing IPOs in to date after listing. Login Now. A total number of - shares have been offered in this public issue of Adani Wilmar Ipo, out of this total share - shares have been allotted for Fresh Issue and another - shares are to be offered for OFS offer for sale. Currently, the firm has 22 plants across 10 states in India comprising 10 crushing units and 18 refineries.

0 thoughts on “Adani wilmar ipo expected listing price”