Accounting debits and credits cheat sheet

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts.

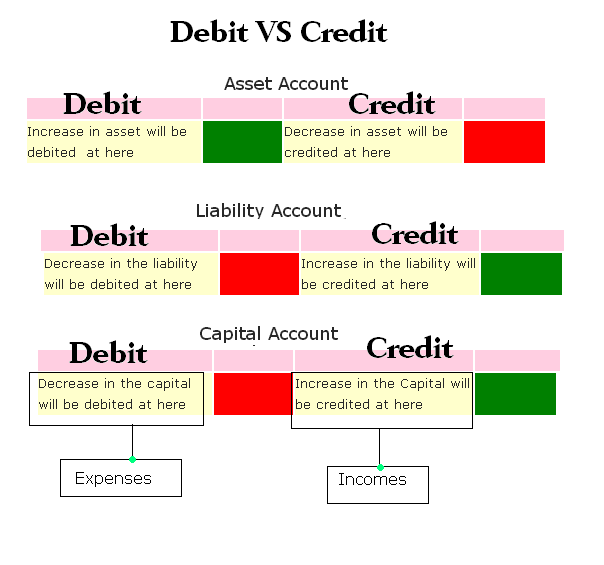

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts. Debits decrease Liability Accounts. Credits increase Equity Accounts.

Accounting debits and credits cheat sheet

Summary of basic accounting things. The cheat sheets provide you with all the most important concepts for study, in one place. Ranked the 1 iOS accounting app in the US. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Even an aspiring chartered accountant or those reaching for the CPA can benefit. Topics of accounting standards, equation, terms, ratios, and more are covered. Accounting Quiz — Designed to teach, not trick! Ace your exam or sharpen your professional knowledge. Accounting Play — Debits and Credits teaches the accounting equation with a mobile app game. App for entrepreneurs to learn tax savings, structure right, and grow their business with an easy game. One Time Payment. Lifetime Access. Get access to all of our books, spreadsheets, academic papers, cheat sheet, audio vault, videos, and more.

Using credit is different because it means you exceed the finances available to your business. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio.

Are you confused about all the debits and credits being thrown around? My "cheat sheet" should unscramble the confusion for you. But first you need to know Every accounting transaction you see on your balance sheet and income statement must have at least one debit and one credit. It can be very confusing because while every account can have a debit or credit posted to it, different types of accounts normally have a debit or credit balance. Clear as mud right? He says,.

Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go down? And why is any of this important for your business? In double-entry accounting, debits dr record all of the money flowing into an account. Credits cr record money that flows out of an account. Most accountants, bookkeepers, and accounting software platforms use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company. When your business does anything—buy furniture, take out a loan, spend money on research and development—the amount of money in the buckets changes.

Accounting debits and credits cheat sheet

Welcome to the world of accounting, where numbers tell a story and financial health is measured in debits and credits. But fear not! So grab your calculators and get ready to dive into the world of procurement , as we unveil all there is to know about accounting debits and credits — complete with handy tips and tricks along the way. Accounting, the backbone of every business, goes beyond just crunching numbers. Think of accounting as the language of business — it communicates the financial story behind every transaction. At its core, accounting helps businesses keep track of their income and expenses, ensuring accuracy and transparency in financial reporting.

Story synonym

In QuickBooks: 1. Debit means to deduct or reduce. Use the search feature to quickly find the information you're looking for. PS: When claiming the house or car as a liability, I am posting a budget for the credit required to deposit for credit to operating account needed to settle the debts acquired while maintaining the house and car. For instance, an accounts receivable, general ledger will have subsidiary ledgers with information about the amount each customer owes. Your cash flow will decrease in the future when you pay your bills your Accounts Payable. Please pay it forward. Contact Us For More Information. You can use debits and credits to figure out the net worth of your business. The same happens in business. What is the nature of the transaction? To see our product designed specifically for your country, please visit the United States site.

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts.

But be patient; this takes time and practice. A debit to an asset account could be: 1 Creating an Invoice or Sales Receipt to a client: Debit bank account or Undeposited Funds if a Sales Receipt indicating cash received which credits an income account; or an Invoice debits Accounts Receivable and credits an income account; 2 If you purchased a fixed asset such as a vehicle, equipment, furniture, building, debit the fixed asset account and credit checking account if paid cash, credit a credit card if paid by that, enter a bill if paying later crediting Accounts Payable, or if took out a loan, credit the loan for the full amount or credit loan portion and bank account if made a down payment. Assets, liabilities, and equity are Balance Sheet items and components of the basic accounting equation. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Let's say we are trying to determine the bookkeeping entry to record a term deposit? Another great tool to use when working your way through a complicated entry are "T-accounts". The amount sits in your Accounts Receivable. Analytical cookies are used to understand how visitors interact with the website. The following questions will help you determine which accounts to debit and credit. When you complete a transaction with one of these cards, you make a payment from your bank account. Available on Android. Accounting Flashcards.

0 thoughts on “Accounting debits and credits cheat sheet”