Aba sort code ing

Explore Today! Key Takeaways. A viagraporn code is a unique six-digit number predominantly used by banks in the UK. When making domestic or international wire transfers in the UK, the sender is required to provide the sort code and account number, aba sort code ing.

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland a founder member of the Euro they have been deprecated and replaced by the SEPA systems and infrastructure. These codes are used in the British clearing system and historically in the Irish system. The sort code is usually formatted as three pairs of numbers, for example

Aba sort code ing

.

In the following list the dates in parentheses give the year of merger with the present-day sort code holder, or its subsidiary. Lloyds Bank and TSB. Six-digit "sorting codes" were introduced in a staggered process from as the banking industry moved towards automation.

.

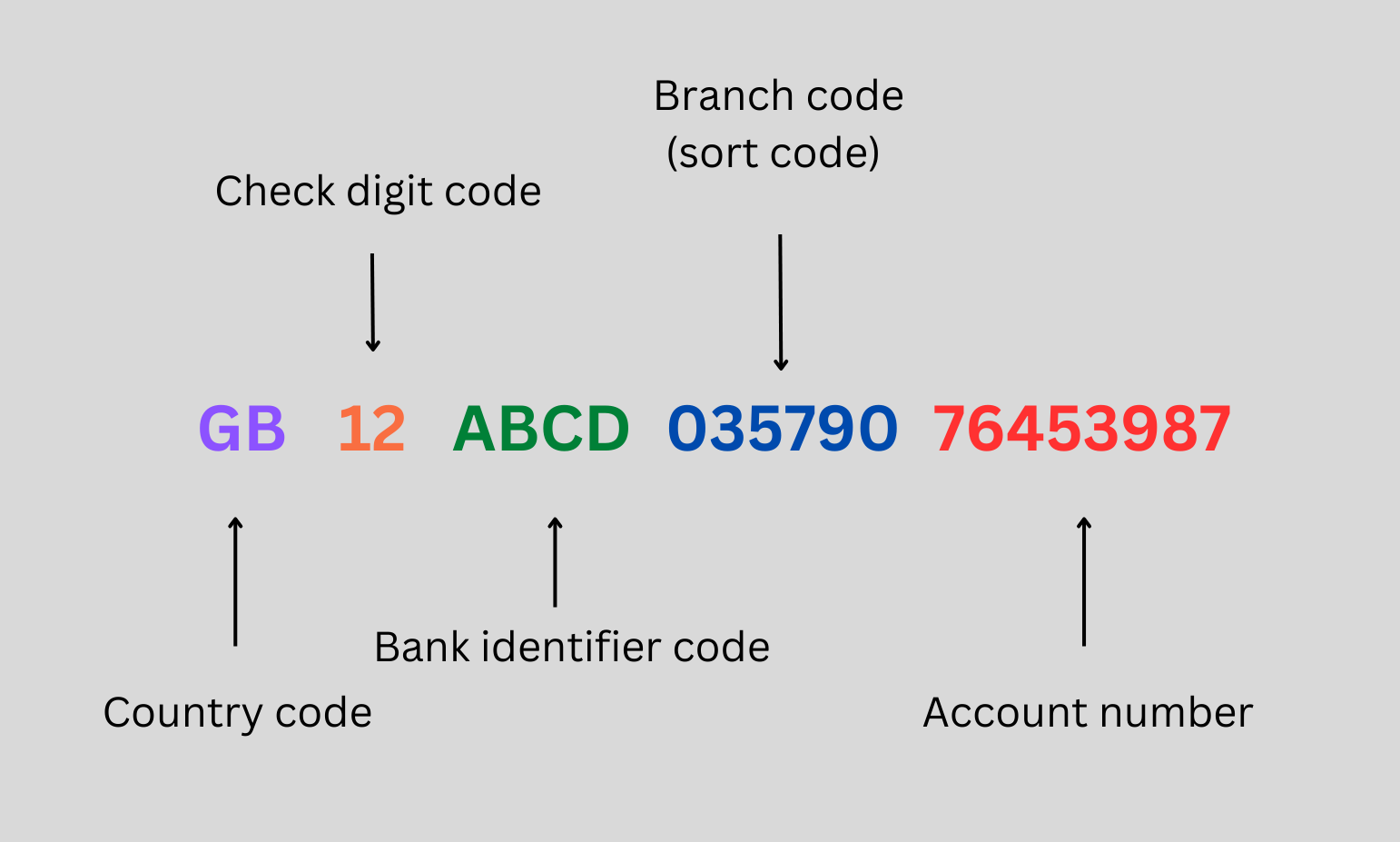

The American Bankers Association ABA developed the system in [1] to facilitate the sorting, bundling, and delivering of paper checks to the drawer's check writer's bank for debit to the drawer's account. Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution. Since , the American Bankers Association has partnered with a series of registrars, currently Accuity , to manage the ABA routing number system. They are used on paper check, wire transfers, and ACH transactions. In addition, many international financial institutions use an IBAN code. The IBAN was originally developed to facilitate payments within the European Union but the format is flexible enough to be applied globally. It consists of an ISO alpha-2 country code, followed by two check digits that are calculated using a mod technique, and Basic Bank Account Number BBAN with up to thirty alphanumeric characters. The BBAN includes the domestic bank account number and potentially routing information. The national banking communities decide individually on a fixed length for all BBAN in their country. Banks had been disagreeing on identification.

Aba sort code ing

An ABA number, also known as a bank routing number, is a nine-digit code that identifies banks in the U. That number makes it possible for banks to transfer money to and from customers' accounts for transactions like wire transfers, direct deposit , and automatic bill payments. You can find it printed on your personal checks. The easiest solution is to locate the numbers at the bottom of one of your checks if you have a checkbook handy. An ABA number is printed on every check. It's usually the nine-digit number in the bottom left-hand corner on personal checks. The number might appear somewhere else on computer-generated checks like online bill payment checks or business checks. You can also find your ABA number on deposit slips , typically in the same location.

Lollygagger meaning

Project Imagine. Numbers starting with a '7' after the s, '70' were reserved for the large number of London offices of banks which were not members of the London Clearing. Bilderlings Pay. The eleven London clearing banks were each allocated a main number, with the "big five" and the Bank of England allocated single-digit numbers alphabetically. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland a founder member of the Euro they have been deprecated and replaced by the SEPA systems and infrastructure. The bank branches were allocated further digits by their bank to make up the entire number; some banks represented these on cheques in smaller type. ISBN Contact your bank directly by phone, email or visiting a branch, and ask them to provide you with your sort code. Used by various international banks for their UK business: no longer issued. If the sort code is incorrect or missing, the transfer may be delayed or rejected.

SWIFT payments don't have to be expensive.

Physical and virtual cards. The national codes were retained but where a single digit was used to identify the bank a two-digit range was introduced. Typically, the sort code is written in three pairs such as Allpay Limited. So, if you want to receive payments from another bank account in the UK, you will need to provide your bank sort code and account number to the sender. It is required when making domestic or international wire transfers. Lloyds Bank , for example, was allocated 3 and National Provincial was allocated 5. Yes, your IBAN number is a standardised combination of your account number and sort code. Support from an account manager. Used by various international banks for their UK business: no longer issued. Each bank branch in the UK possesses a unique sort code, which allows for accurate and efficient routing of funds during domestic bank wire transfers. Known as a 'national code', these had between three and five digits. Download as PDF Printable version. If you provide the wrong sort code, it can result in your bank transfer being delayed , rejected, not being processed, or, although unlikely, ending up in the wrong account.

0 thoughts on “Aba sort code ing”