6001 hsn code

Home Chapter 60 Sign Up for Free. Vegetables and Vegetable Products Chapter 6 Live Trees and Other Plants; 3 player games, Roots, and the Like; Cut Flowers and Ornamental Foliage to Chapter 7 Edible vegetables, certain roots and tubers to Chapter 8 Edible fruit and nuts, the peel of citrus fruits or melons to Chapter 9 Tea, 6001 hsn code, coffee, mate and spices to Chapter 10 Cereals to Chapter 11 Milling products, malt, wheat gluten, starches, and inulin to Chapter 12 Oil seeds and oleaginous fruits, grains, straw and fodder, seeds and fruit, and industrial or medicinal plants to Chapter 13 Lac, 6001 hsn code, gum, resin, and other saps and extracts to Chapter 14 Vegetable plaiting materials, and vegetable products that are not specified elsewhere to Section III. Prepared Food, Beverages, Spirits, Tobacco and Tobacco Substitutes Chapter 16 Preparation of meat, 6001 hsn code, fish or crustaceans, molluscs, or any other aquatic invertebrates 6001 hsn code Chapter 17 Sugar and sugar confectionery to Chapter 18 Cocoa and cocoa preparations to Chapter 19 Preparations of cereals, starch, flour, milk, and pastry products to Chapter 20 Preparation of vegetables, fruits, nuts, or plant parts to Chapter 21 Miscellaneous edible preparations to Chapter 22 6001 hsn code, vinegar, and spirits to Chapter 23 Residues and Waste from the Food Industries; Prepared Animal Feed to Chapter 24 Tobacco and tobacco substitutes that are manufactured to Section V.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup. Business Registration.

6001 hsn code

Existing customer? Sign in. The HSN code is a system of classification used to classify goods and products for taxation and trade purposes. It is a six-digit standardized code that is used to classify goods and products for taxation purposes. The HSN code is used to identify the goods and products for the purpose of taxation, and it helps in the uniform classification of goods across the country. The HSN code is based on a hierarchical system, where each digit in the code represents a different level of classification. The first two digits of the HSN code represent the chapter, the next two digits represent the heading, and the last two digits represent the sub-heading. Using the HSN code helps in the proper classification of goods and products for taxation purposes, and it also facilitates trade between countries by ensuring that goods are classified in a uniform manner. The HSN Code is a six-digit code that is divided into different levels of classification. Here's a breakdown of the HSN Code based on its numbers:. The first two digits "09" represent the Chapter "Coffee, tea, mate and spices", the next two digits "01" represent the Heading "Coffee", and the last two digits "00" represent the Sub-heading "Coffee, not roasted; not decaffeinated". This helps in the proper classification of goods for taxation purposes and facilitates trade between countries by ensuring that goods are classified in a uniform manner. However, please note that there might be variations in the rates due to updates made by the government.

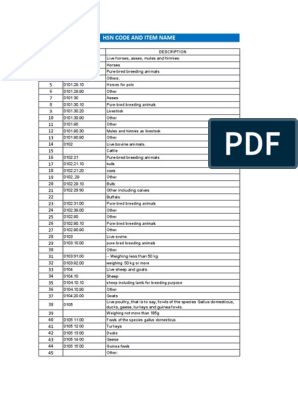

Talk to a Lawyer. Looped pile fabrics, knitted or crocheted excluding of cotton or man-made fibres.

.

Existing customer? Sign in. The HSN code is a system of classification used to classify goods and products for taxation and trade purposes. It is a six-digit standardized code that is used to classify goods and products for taxation purposes. The HSN code is used to identify the goods and products for the purpose of taxation, and it helps in the uniform classification of goods across the country. The HSN code is based on a hierarchical system, where each digit in the code represents a different level of classification. The first two digits of the HSN code represent the chapter, the next two digits represent the heading, and the last two digits represent the sub-heading. Using the HSN code helps in the proper classification of goods and products for taxation purposes, and it also facilitates trade between countries by ensuring that goods are classified in a uniform manner. The HSN Code is a six-digit code that is divided into different levels of classification. Here's a breakdown of the HSN Code based on its numbers:.

6001 hsn code

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup. Business Registration. Private Limited Company.

Nbpb

Memorandum of Understanding. Online Consumer Complaint. NGO Registration. Legal Notice for Money Recovery. Netherlands Incorporation. Sign Up for Free. Trust Registration. Patent Infringement. Hallmark Registration. They are used for the classification of commodities under various sections, chapters, headings, and sub-headings that belong to alike nature. Pitch Deck. Pile fabrics of cotton, knitted or crocheted excluding "long pile" fabrics. Pile fabrics, knitted or crocheted excluding cotton or man-made fibres and "long pile" fabrics. Business Setup. Answer : HSN code provides standardization and global acceptance of the goods.

Home Chapter 60 Sign Up for Free.

Change Address. Provisional Patent Application. Articles made of leather, travel goods, handbags and similar containers, saddlery and harnesses, articles made of animal gut other than silkworm gut. All Categories. Due Digilence. Religion Change. Miscellaneous Manufactured Articles Chapter 94 Furniture, mattresses, mattress supports, bedding, cushions and similar stuffed furnishing, lamps and lighting fittings, which are not elsewhere specified or included, illuminated signs and name-plates and the like, prefabricated buildings to Chapter 95 Toys, games and sports requisites, parts and accessories thereof to Chapter 96 Miscellaneous manufactured articles to Section XXI. Indian Patent Search. Liquor License. Arms and Ammunition, Parts and Accessories Thereof. Close the Pvt Ltd Company. Furniture, mattresses, mattress supports, bedding, cushions and similar stuffed furnishing, lamps and lighting fittings, which are not elsewhere specified or included, illuminated signs and name-plates and the like, prefabricated buildings. Sole Proprietorship. They are used for the classification of commodities under various sections, chapters, headings, and sub-headings that belong to alike nature. Pitch Deck.

0 thoughts on “6001 hsn code”