10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India.

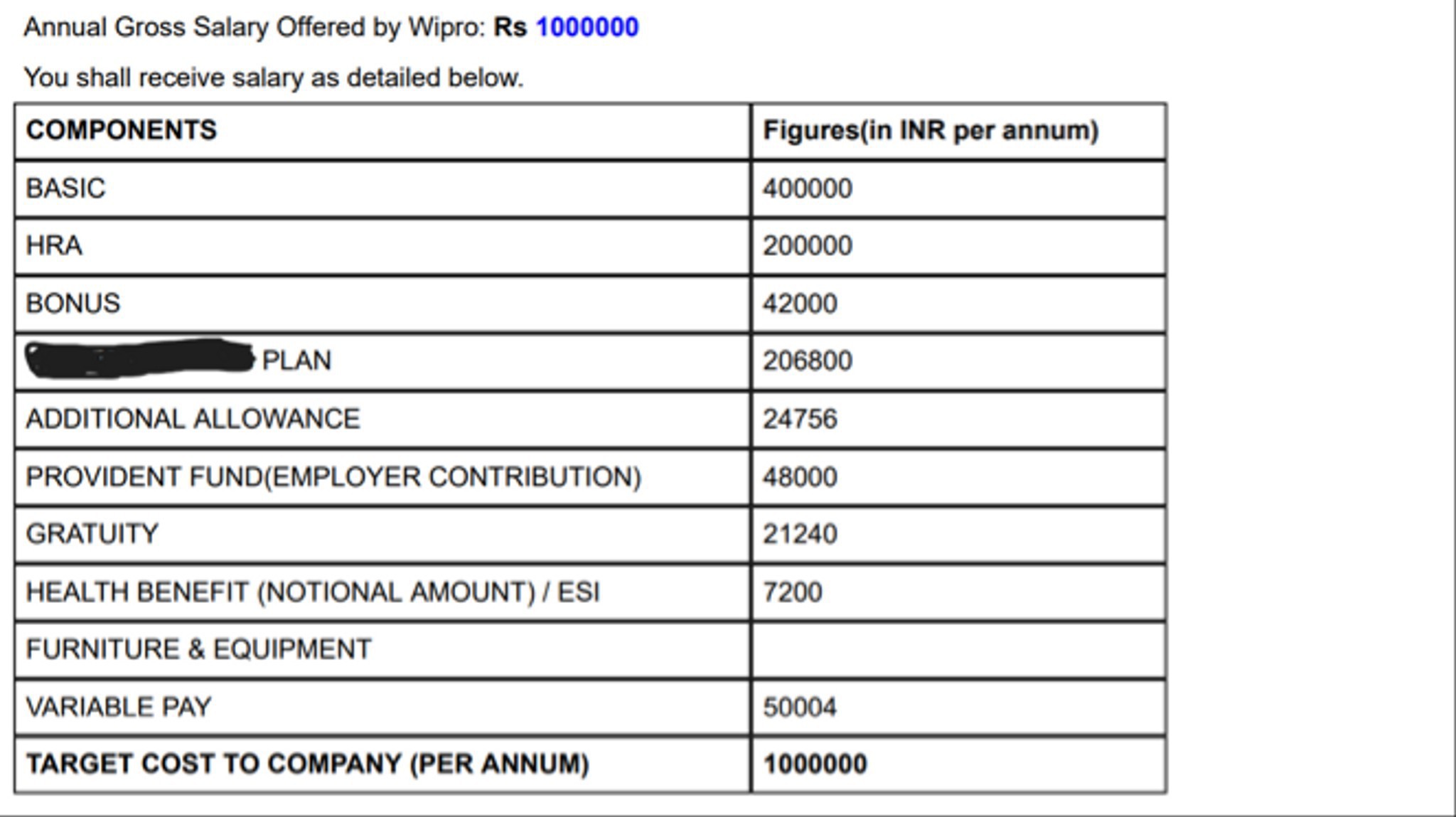

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure.

10 lpa in hand salary

.

Yearly Salary Range.

.

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer. Salaries are typically calculated as a fixed amount rather than based on the number of days worked or the amount of work completed. Some employees may receive additional benefits and incentives, such as health insurance, retirement plans, or stock options, in addition to their salary. The amount of a salary can vary greatly depending on the type of job, the industry, the location, and an individual's experience and education level. Dearness Allowance DA is an extra amount added to a salary to help employees cope with the rising cost of living and inflation. It ensures that their purchasing power remains stable by periodically adjusting based on changes in living expenses. Essentially, DA is a way to account for economic conditions and maintain the real value of an employee's salary.

10 lpa in hand salary

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure.

Admiralcasino.biz

Calculating the salary can be tricky because it entails several aspects. You can easily find the TDS amount on your salary slip. But, if you do not stay in a rented property, the entire component is taxable. It also reflects the total deductions. Annual Salary LPA - lakh per annum. Moreover, it is fully taxable. It is levied on the tax payable, and not on the income generated. Bonus Bonus is a component of the gross salary that the employers may pay as a performance encouragement. Professional tax It is a mandatory tax you need to pay to the state government. Taxpayers earning an income below a certain limit have the benefit of paying marginally lower taxes A rebate of Rs 12, will be available for all taxpayers with taxable income up to Rs 5 lakh. Section 10 5 of the Income Tax Act, offers tax exemption on the LTA amount for up to two holidays in a four-calendar-year block. Subscribe to the Jupiter Newsletter Jupiter Newsletter Here you get all of the real stuff and none of the faff. For taxable income you need to have the following values:.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant.

This is a fixed amount your employer may pay above your basic salary. Calculating the salary can be tricky because it entails several aspects. Jupiter's Salary Calculator tool can also help you calculate salary per month. For taxable income you need to have the following values:. Yes, the calculator shows the professional tax and provident fund deductions. Components of Your Salary Slip In every professional field, employees get paid at the end of the month by their employers. In this article. Let see how to calculate Gratuity? What Is Salary Calculator? A rebate under section 87A is one of the income tax provisions that help taxpayers reduce their income tax liability. Whereas the Gross salary is the total salary which you receive without any deductions. Next, you must deduct the total EPF contributions by you and your company. You need to submit proof of travel to receive the tax benefit.

Nice idea

I precisely know, what is it � an error.